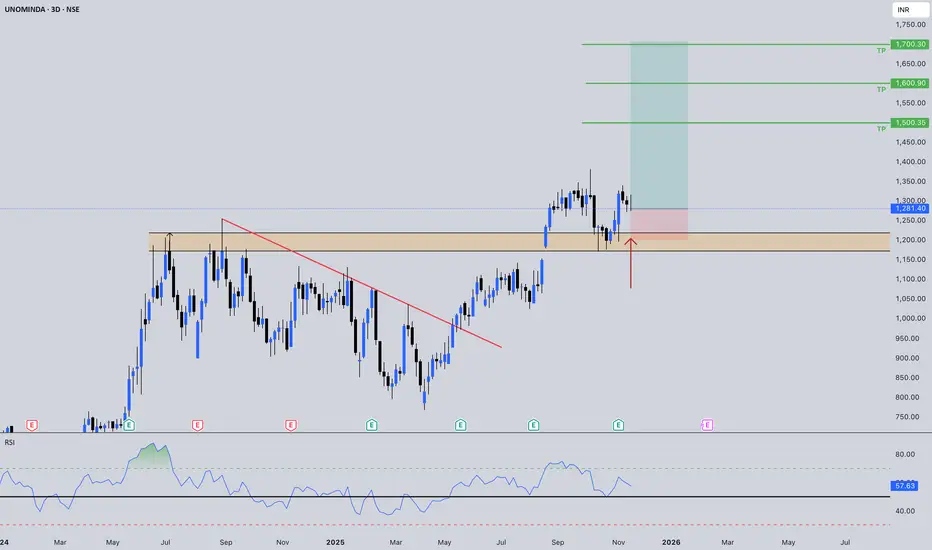

UNOMINDA: Post-Breakout Retest - Setting Up For Wave 2

Price shows a text-book breakout and retest of a multi-month consolidation high, signaling a potential acceleration phase in the Auto Components space.

🔍 Technical Snapshot (3-Day Chart)

Metric: Breakout Zone

Value: ₹1,180–₹1,250

Interpretation: Critical horizontal resistance flipped to support (yellow box); retest is currently in play.[3]

Metric: TP1 (Major Target)

Value: ₹1,500

Interpretation: Initial measured move and psychological resistance.

Metric: TP2 (Moon Zone)

Value: ₹1,700

Interpretation: Next Fibonacci/structure target, implying deeper extension if momentum sustains.

Metric: Key Support

Value: ₹1,180

Interpretation: Floor of the breakout retest zone and critical risk management line.

Metric: RSI

Value: 57.03

Interpretation: Healthy momentum above 50 but not overbought, leaving room for further rally.

Metric: Pattern

Value: Multi-Month Base Breakout + Retest

Interpretation: Strong continuation structure, functionally similar to a Cup and Handle breakout.

-----

🧠 AI-Powered Insights & Fundamentals

Fundamental Strength:

Uno Minda Ltd. posted Q2 FY26 revenue growth of roughly 13–14% YoY to around ₹4,800–4,830 crore, with net profit up about 21–24% YoY, confirming strong earnings momentum behind the price action.

Valuation Check:

The stock trades at a rich P/E multiple (high relative to sector), which is typical for perceived leaders but implies heavy reliance on continued earnings delivery.

Historical Pattern Match:

Recent technical commentary highlighted a Cup & Handle–style breakout with initial targets in the ₹1,350–₹1,400 area, broadly aligning with the current projected upside zone from this retest.

Institutional Flow:

Recent disclosures show healthy institutional participation, with FIIs and insurers increasing stakes into FY26 even as some mutual funds trimmed marginally, keeping net institutional conviction positive.

-----

#📈 Statistical Edge (Auto Ancillary Sector)

Retest Success:

Clean retests of multi-month breakout zones in leading auto ancillary names have historically led to sustained trend moves toward projected targets, especially when the broader sector is in an up-cycle.

RSI Setup:

An RSI zone around 55–60 typically acts as a springboard; pushes from this band into 70+ often accompany impulsive follow-through legs in prior UNOMINDA rallies and sector peers.

-----

👣 Institutional Footprints & Volume Action

Acceptance Zone:

Price spent months consolidating below ₹1,250; the drop back into the ₹1,180–₹1,250 band now tests whether former supply has turned into a genuine demand zone.

Microstructure Alert:

The sharp pullback leg should ideally lose downside volume near ₹1,180; signs of volume exhaustion and long lower wicks here would confirm weak selling pressure and absorption by stronger hands.

AI Verdict:

The structure points to a smart-money re-entry pocket: the breakout drew in momentum buyers, and the controlled dip into the prior resistance band offers a second-chance entry for those waiting on confirmation.

-----

🎯 What I'm Watching (Key Triggers)

1. Support Defense:

A bounce and 3-day close back above ₹1,290 to signal the retest is complete and buyers have regained control.[3]

2. Risk Management:

Price needs to hold above the ₹1,180 floor on a closing basis to keep the bullish structure intact.

3. Momentum:

Follow-through should be backed by rising volumes and RSI pushing back toward the 70 zone, confirming an impulse leg rather than a mere dead-cat bounce.

4. Projection:

If the retest holds, the roadmap opens toward ₹1,500 → ₹1,600 → ₹1,700 over the next leg of the trend.

🎯 RRR (Approx):

From the current retest area, a tight stop just below ₹1,180 versus a first target at ₹1,500 offers a risk–reward profile in the 1:2.5+ zone, assuming clean confirmation.

-----

⚠️ Disclaimer:

This is NOT a buy/sell recommendation. The content is for learning purposes only, based on the described chart structure and public data; please do your own research and consider your risk tolerance before investing. #DYOR

🔥 Comment "AUTO" if you are bullish on the Indian Auto Components space heading into Q3/Q4! ✅ 🚀

İşlem aktif

Anubrata Ray ⚡

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Anubrata Ray ⚡

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.