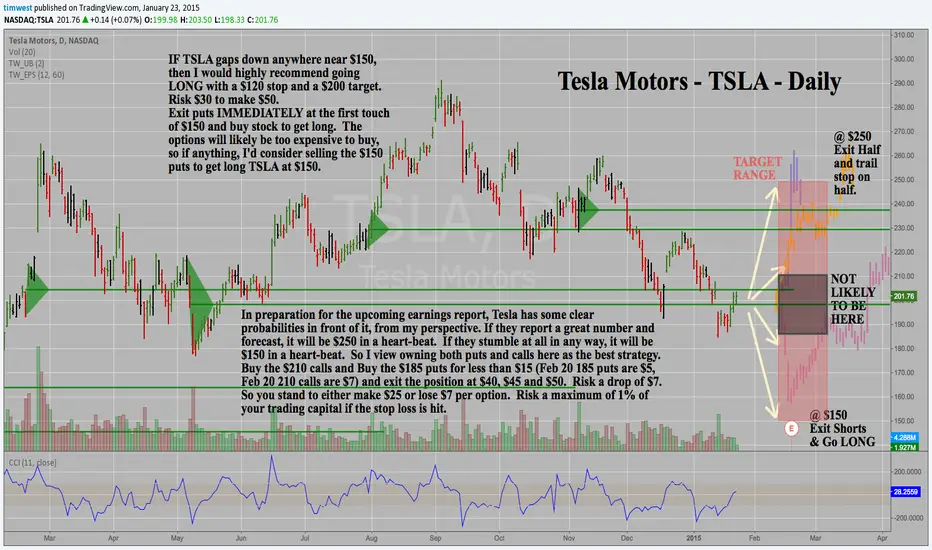

In preparation for the upcoming earnings report, Tesla has some clear probabilities in front of it, from my perspective. If they report a great number and forecast, it will be $250 in a heart-beat. If they stumble at all in any way, it will be $150 in a heart-beat. So I view owning both puts and calls here as the best strategy. Buy the $210 calls and Buy the $185 puts for less than $15 (Feb 20 185 puts are $5, Feb 20 210 calls are $7 for a total of $12 currently) and exit the position at $40, $45 and $50. Risk a drop of $7. So you stand to either make $30+ or lose $7 per option (Options represent 100 shares of stock, so the smallest risk here is $700 for one strangle). Risk a maximum of 1% of your trading capital if the stop loss is hit.

IF TSLA gaps down anywhere near $150, then I would highly recommend going LONG with a $120 stop and a $200 target. Risk $30 to make $50. Exit puts IMMEDIATELY at the first touch of $150 and buy stock to get long. The options will likely be too expensive to buy, so if anything, I'd consider selling the $150 puts to get long TSLA at $150.

Why am I publishing this now since earnings are so far off? Because I feel strongly about this trade now and think this is a reasonable risk/reward and if oil rallies back up, then TSLA will lift now. If oil melts down further, then TSLA will sink. If Oil holds steady AND TSLA has a great forecast for Model-X, then TSLA will skyrocket. I think it is safe to bet AGAINST TSLA staying at this price over the longer term when a YEAR AGO I thought TSLA was a good bet to go sideways. (See previous forecasts).

OH - And we need a new button here at Tradingview to click on BOTH "LONG" and "SHORT".... I'll choose LONG just because I'm cheering for TSLA, but I don't want to have my comment be considered NEUTRAL!

Cheers.

Tim 12:50PM EST Friday, January 23, 2015

IF TSLA gaps down anywhere near $150, then I would highly recommend going LONG with a $120 stop and a $200 target. Risk $30 to make $50. Exit puts IMMEDIATELY at the first touch of $150 and buy stock to get long. The options will likely be too expensive to buy, so if anything, I'd consider selling the $150 puts to get long TSLA at $150.

Why am I publishing this now since earnings are so far off? Because I feel strongly about this trade now and think this is a reasonable risk/reward and if oil rallies back up, then TSLA will lift now. If oil melts down further, then TSLA will sink. If Oil holds steady AND TSLA has a great forecast for Model-X, then TSLA will skyrocket. I think it is safe to bet AGAINST TSLA staying at this price over the longer term when a YEAR AGO I thought TSLA was a good bet to go sideways. (See previous forecasts).

OH - And we need a new button here at Tradingview to click on BOTH "LONG" and "SHORT".... I'll choose LONG just because I'm cheering for TSLA, but I don't want to have my comment be considered NEUTRAL!

Cheers.

Tim 12:50PM EST Friday, January 23, 2015

Subscribe to my indicator package KEY HIDDEN LEVELS $10/mo or $100/year and join me in the trading room KEY HIDDEN LEVELS here at TradingView.com

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

Subscribe to my indicator package KEY HIDDEN LEVELS $10/mo or $100/year and join me in the trading room KEY HIDDEN LEVELS here at TradingView.com

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.