🔮 Weekly  SPY /

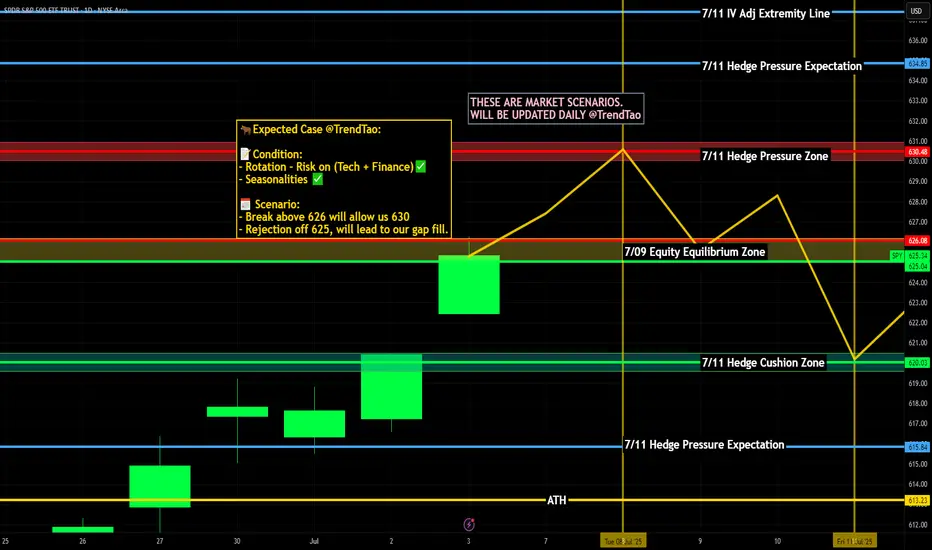

SPY /  SPX Scenarios for July 7–11, 2025 🔮

SPX Scenarios for July 7–11, 2025 🔮

🌍 Market‑Moving News 🌍

📈 From Panic to "Goldilocks" Rally

The S&P 500 and Nasdaq hit fresh record highs, surging ~20% from April lows. Markets rallied on a combination of easing Middle East tensions, the 90‑day tariff pause, a new fiscal bill in Washington, and strong June jobs data. Still, strategists caution that optimism may be ahead of fundamentals, especially if trade volatility returns

💱 Dollar Weakness & Bond Market Watch

The U.S. dollar remains near 3.5‑year lows amid rate‑cut speculation and trade progress. Treasury yields are volatile this week, impacted by concerns over escalating debt issuance, upcoming tariff deadlines (July 9), and the Federal Reserve’s stance .

🏢 Tech Leadership Shifts

With the “Magnificent Seven” tech stocks near heights, growth is spreading: cyclical sectors, small‑caps, and industrials are gaining momentum. AI remains the primary engine, but resilience across a broader stock base is signaling a potentially sustainable rally

⚠️ Tariff Truce Deadline Looms (July 9)

The April tariff pause expires mid‑week. U.S. plans to extend exemptions via trade talks with partners like UK, Vietnam, and Canada—yet any delay or failure may shock markets. Watch for headlines that may trigger spillover effects .

📊 Key Data Releases & Events 📊

📅 Monday, July 7:

Independence Day markets resume. Light trading expected ahead of data and tariff deadline.

📅 Tuesday, July 8:

10:00 AM ET – Consumer Credit (June)

Gauges borrowing trends—an indicator of household health in a low‑rate environment.

📅 Wednesday, July 9:

EIA Crude Oil Inventories & MBA Mortgage Apps & Wholesale Inventories

Key mid‑week data points; oil builds may pressure energy stocks.

Tariff Pause Deadline – Expect market volatility on news of extension or reimposition.

📅 Thursday, July 10:

8:30 AM ET – Initial & Continuing Jobless Claims

10:00 AM ET – Natural Gas Inventories

Markets focus on labor health and energy trends.

📅 Friday, July 11:

10:00 AM ET – Treasury Budget Statement

Details on government borrowing and fiscal outlook—markets sensitive to deficit risks.

⚠️ Disclaimer:

These insights are for educational purposes only—not financial advice. Consult a licensed advisor before making investing decisions.

📌 #trading #stockmarket #economy #news #tariffs #Fed #AI #technicalanalysis

🌍 Market‑Moving News 🌍

📈 From Panic to "Goldilocks" Rally

The S&P 500 and Nasdaq hit fresh record highs, surging ~20% from April lows. Markets rallied on a combination of easing Middle East tensions, the 90‑day tariff pause, a new fiscal bill in Washington, and strong June jobs data. Still, strategists caution that optimism may be ahead of fundamentals, especially if trade volatility returns

💱 Dollar Weakness & Bond Market Watch

The U.S. dollar remains near 3.5‑year lows amid rate‑cut speculation and trade progress. Treasury yields are volatile this week, impacted by concerns over escalating debt issuance, upcoming tariff deadlines (July 9), and the Federal Reserve’s stance .

🏢 Tech Leadership Shifts

With the “Magnificent Seven” tech stocks near heights, growth is spreading: cyclical sectors, small‑caps, and industrials are gaining momentum. AI remains the primary engine, but resilience across a broader stock base is signaling a potentially sustainable rally

⚠️ Tariff Truce Deadline Looms (July 9)

The April tariff pause expires mid‑week. U.S. plans to extend exemptions via trade talks with partners like UK, Vietnam, and Canada—yet any delay or failure may shock markets. Watch for headlines that may trigger spillover effects .

📊 Key Data Releases & Events 📊

📅 Monday, July 7:

Independence Day markets resume. Light trading expected ahead of data and tariff deadline.

📅 Tuesday, July 8:

10:00 AM ET – Consumer Credit (June)

Gauges borrowing trends—an indicator of household health in a low‑rate environment.

📅 Wednesday, July 9:

EIA Crude Oil Inventories & MBA Mortgage Apps & Wholesale Inventories

Key mid‑week data points; oil builds may pressure energy stocks.

Tariff Pause Deadline – Expect market volatility on news of extension or reimposition.

📅 Thursday, July 10:

8:30 AM ET – Initial & Continuing Jobless Claims

10:00 AM ET – Natural Gas Inventories

Markets focus on labor health and energy trends.

📅 Friday, July 11:

10:00 AM ET – Treasury Budget Statement

Details on government borrowing and fiscal outlook—markets sensitive to deficit risks.

⚠️ Disclaimer:

These insights are for educational purposes only—not financial advice. Consult a licensed advisor before making investing decisions.

📌 #trading #stockmarket #economy #news #tariffs #Fed #AI #technicalanalysis

İlgili yayınlar

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

İlgili yayınlar

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.