Fundamentals:

Company is undergoing a turnaround. Recent profits are negative, with high leverage, but cash reserves are strong and asset quality is improving.

Valuation is in deep value territory (P/B < 1), business model focuses on digital, scalable, asset-light lending.

Major upcoming change: Abu Dhabi’s IHC/Avenir to acquire 43.5% promoter stake, infusing ₹8,850 crore, signaling commitment to future growth.

Technical View:

Momentum is strong: price surged +5% today, over 25% in a month.

All major indicators (trend, moving averages, oscillators) show strong bullish signals and favor accumulation for momentum trades.

Fundamental Analysis

Company is undergoing a turnaround. Recent profits are negative, with high leverage, but cash reserves are strong and asset quality is improving.

Valuation is in deep value territory (P/B < 1), business model focuses on digital, scalable, asset-light lending.

Major upcoming change: Abu Dhabi’s IHC/Avenir to acquire 43.5% promoter stake, infusing ₹8,850 crore, signaling commitment to future growth.

Technical View:

Momentum is strong: price surged +5% today, over 25% in a month.

All major indicators (trend, moving averages, oscillators) show strong bullish signals and favor accumulation for momentum trades.

Fundamental Analysis

- Market Cap: ~₹14,047 crore

- Revenue (TTM): ₹8,947 crore

- Net Profit (TTM): −₹1,800 crore (negative)

- P/E Ratio: Negative (-7.83), due to losses

- P/B Ratio: 0.65 (value stock territory)

- P/S Ratio: 1.58

- Solvency Score: 32/100 (low-moderate)

- Profitability Score: 45/100

- Key Balance Sheet Data:

- Current Assets: ₹33.6B

- Cash: ₹33.5B (very high liquidity)

- Long-Term Debt: ₹427.3B (significant leverage)

- Non-current Liabilities: ₹483.5B

Business Model: Primarily housing finance & mortgage lending; strong push for asset-light, tech-driven model; focus on affordable housing

Recent Challenges: Large non-performing assets, but proactive provisioning and improving collections.

Technical bias: Strong Buy.

Momentum is strong: price surged +5% today, over 25% in a month.

Events & News:

Fresh board meeting, capital-raising plans, and an open offer on the horizon.

Trading window closed for insiders due to promoter change and major corporate actions.

Sectoral tailwinds and digital transformation efforts add positive sentiment.

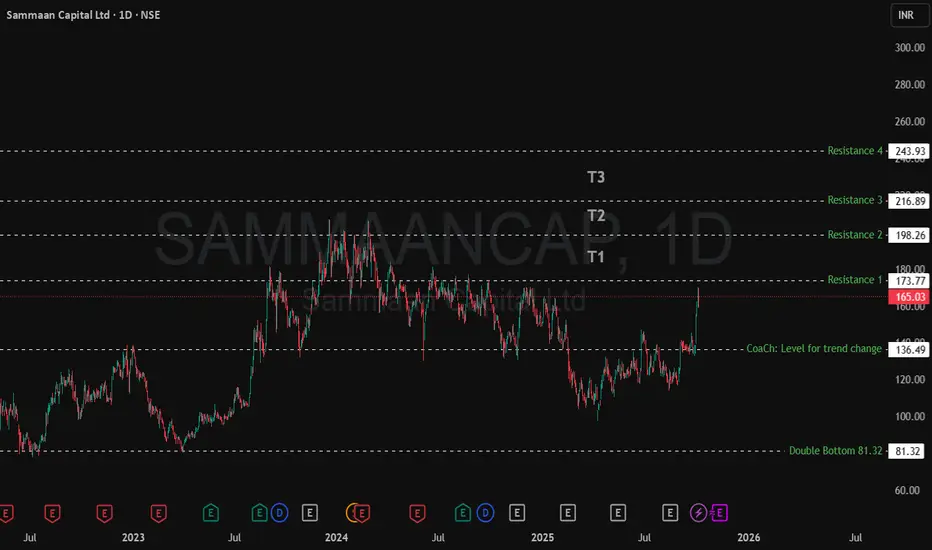

Key Levels (from chart):

Resistance 1 (T1): 173.77

Resistance 2 (T2): 198.26

Resistance 3 (T3): 216.89

Resistance 4: 243.93

CoaCh: Level for trend change: 136.49

Double Bottom: 81.32

Disclaimer:tinyurl.com/59ypbsrh

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.