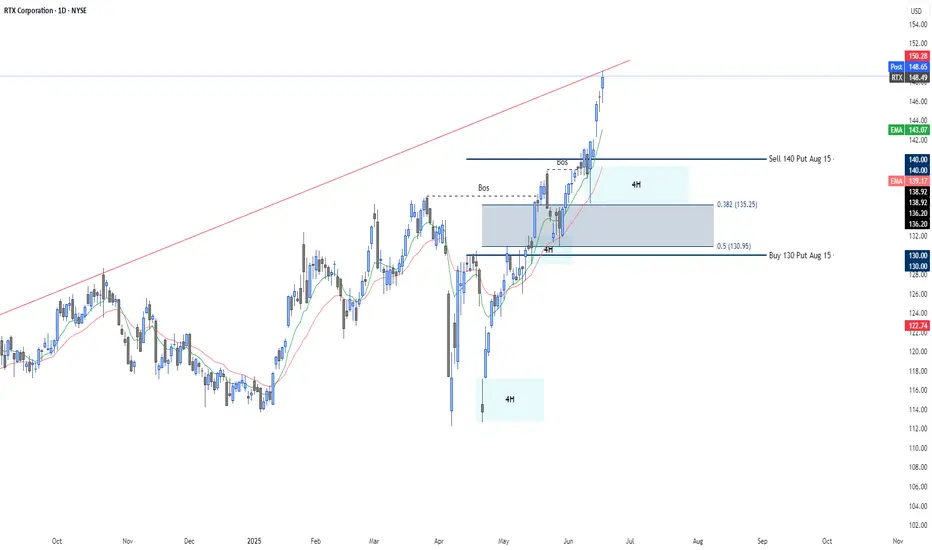

Put Credit Spread Aug 140/130 | Entry: -1.81 | POP 76%

🚀 Technical & Macro Context:

Raytheon Technologies (RTX) is surging amid escalating geopolitical tensions (Iran–Israel conflict) and renewed strength in defense sector fundamentals. The stock has broken multiple resistance levels and is now trading in a parabolic move within a widening bullish channel.

📌 Technically backed setup:

✅ Clear Break of Structure (BoS) confirmed and respected.

🧱 Strong 4H demand zone between $135.25–$130.95.

📉 RSI trending high but not overheated.

📈 MACD remains bullish with wide separation.

This zone aligns with:

Dynamic support (EMA20).

38–50% Fibonacci retracement.

Previous consolidation zone now acting as demand.

🔒 Spread Structure:

Sell Put $140 (Aug 15)

Buy Put $130 (Aug 15)

Probability of Profit (POP): 76%

📉 Invalidation below $130 with volume. Will reassess if demand fails.

📷 The chart already illustrates the setup with institutional logic, break levels, and supply/demand zones.

🔍 If you enjoy structured option setups, technicals with context, and high-probability spreads,

👉 Follow me for more trade ideas like this.

📈 Weekly updates | 🎯 Conviction trades | 🧠 Smart risk-reward

🚀 Technical & Macro Context:

Raytheon Technologies (RTX) is surging amid escalating geopolitical tensions (Iran–Israel conflict) and renewed strength in defense sector fundamentals. The stock has broken multiple resistance levels and is now trading in a parabolic move within a widening bullish channel.

📌 Technically backed setup:

✅ Clear Break of Structure (BoS) confirmed and respected.

🧱 Strong 4H demand zone between $135.25–$130.95.

📉 RSI trending high but not overheated.

📈 MACD remains bullish with wide separation.

This zone aligns with:

Dynamic support (EMA20).

38–50% Fibonacci retracement.

Previous consolidation zone now acting as demand.

🔒 Spread Structure:

Sell Put $140 (Aug 15)

Buy Put $130 (Aug 15)

Probability of Profit (POP): 76%

📉 Invalidation below $130 with volume. Will reassess if demand fails.

📷 The chart already illustrates the setup with institutional logic, break levels, and supply/demand zones.

🔍 If you enjoy structured option setups, technicals with context, and high-probability spreads,

👉 Follow me for more trade ideas like this.

📈 Weekly updates | 🎯 Conviction trades | 🧠 Smart risk-reward

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.