Intraday Technical Outlook (15m Chart)

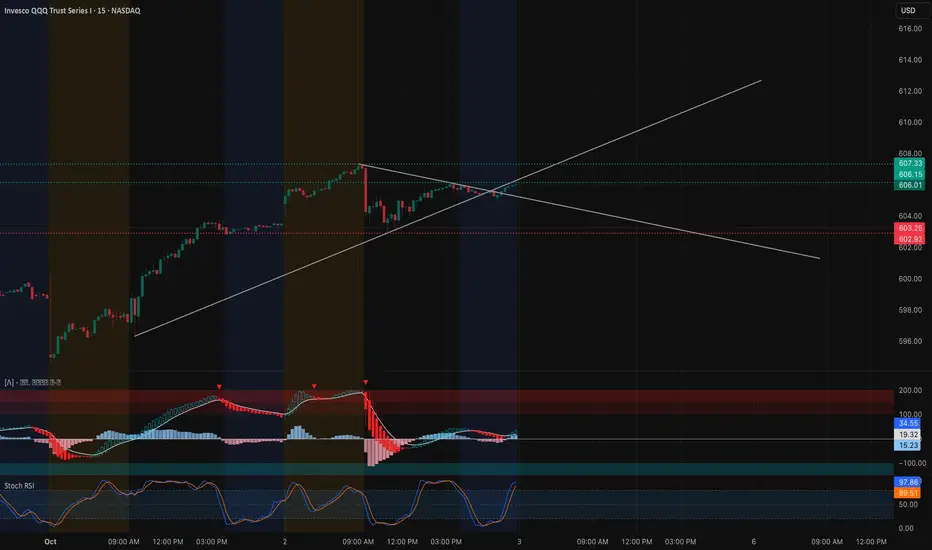

The QQQ closed near $606.01, coiling into a wedge formation after a strong upward push. On the 15-minute chart, the price is sitting right at a confluence of support and resistance trendlines:

* MACD: Starting to recover after a bearish dip, showing early signs of momentum turning back positive.

* Stoch RSI: Pushing back toward overbought, suggesting buyers are regaining control, but overextension risk remains.

* Key Levels: Support sits at $603–602.9, with a deeper floor at $600. Resistance is overhead at $608–610, aligning with the wedge breakout zone.

Intraday takeaway: QQQ is set for a decisive move. Above $608, it could press into $610+, but losing $603 risks a flush back into $600.

Options Sentiment & GEX Outlook (1H Chart)

Gamma exposure highlights a clear battleground for tomorrow’s session:

* Gamma Walls:

* $606–608: Major call resistance cluster and highest positive GEX zone.

* $600: Gamma pivot and HVL level — critical support where dealers may defend.

* $595–590: Heavy put walls below, acting as downside magnets if $600 breaks.

* Implications:

* Holding above $603–606 keeps price magnetized toward $608–610.

* A breakdown under $600 would trigger dealer hedging pressure, driving the Qs toward $595–590.

* Volatility Context: IVR at 17.8 is low, while options positioning skews bearish with 44.8% puts. This suggests traders are hedged defensively, which could amplify a sharp move either way.

My Thoughts & Recommendation

For Oct 3 trading, QQQ is boxed into a gamma range with clear pivot levels:

* Intraday (scalping/trading): Favor longs above $606, aiming for $608–610 breakout. Shorts become attractive on rejections near $608 with downside into $603 and $600.

* Options trading (swing/0DTE): Calls only make sense if QQQ breaks $608 with volume, targeting $610+. If QQQ loses $603 and especially $600, puts toward $595 offer better risk/reward.

Bias heading into Oct 3: Neutral with breakout potential — $608 is the level that decides.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk before trading.

The QQQ closed near $606.01, coiling into a wedge formation after a strong upward push. On the 15-minute chart, the price is sitting right at a confluence of support and resistance trendlines:

* MACD: Starting to recover after a bearish dip, showing early signs of momentum turning back positive.

* Stoch RSI: Pushing back toward overbought, suggesting buyers are regaining control, but overextension risk remains.

* Key Levels: Support sits at $603–602.9, with a deeper floor at $600. Resistance is overhead at $608–610, aligning with the wedge breakout zone.

Intraday takeaway: QQQ is set for a decisive move. Above $608, it could press into $610+, but losing $603 risks a flush back into $600.

Options Sentiment & GEX Outlook (1H Chart)

Gamma exposure highlights a clear battleground for tomorrow’s session:

* Gamma Walls:

* $606–608: Major call resistance cluster and highest positive GEX zone.

* $600: Gamma pivot and HVL level — critical support where dealers may defend.

* $595–590: Heavy put walls below, acting as downside magnets if $600 breaks.

* Implications:

* Holding above $603–606 keeps price magnetized toward $608–610.

* A breakdown under $600 would trigger dealer hedging pressure, driving the Qs toward $595–590.

* Volatility Context: IVR at 17.8 is low, while options positioning skews bearish with 44.8% puts. This suggests traders are hedged defensively, which could amplify a sharp move either way.

My Thoughts & Recommendation

For Oct 3 trading, QQQ is boxed into a gamma range with clear pivot levels:

* Intraday (scalping/trading): Favor longs above $606, aiming for $608–610 breakout. Shorts become attractive on rejections near $608 with downside into $603 and $600.

* Options trading (swing/0DTE): Calls only make sense if QQQ breaks $608 with volume, targeting $610+. If QQQ loses $603 and especially $600, puts toward $595 offer better risk/reward.

Bias heading into Oct 3: Neutral with breakout potential — $608 is the level that decides.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk before trading.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.