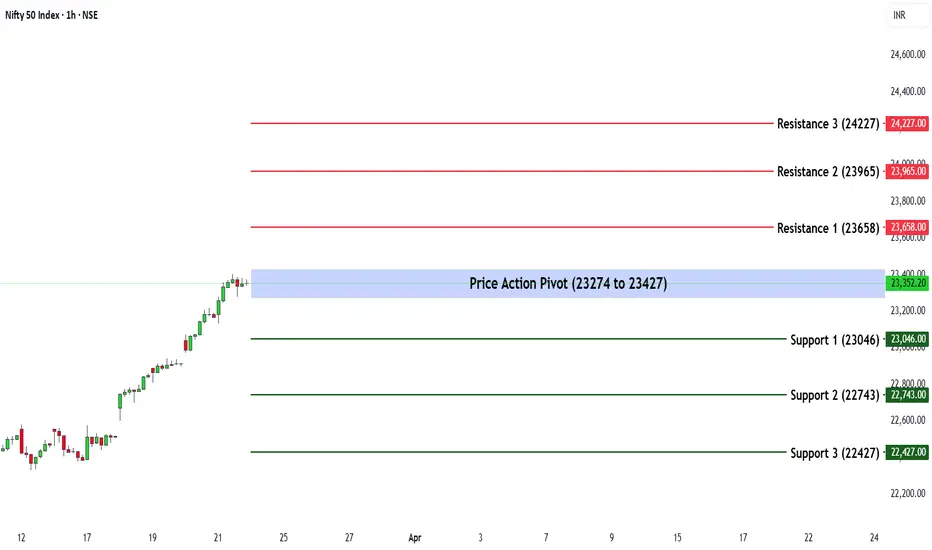

The Nifty 50 ended the week at 23,350.40, recording a notable gain of 4.26%.

Key Levels for the Upcoming Week

🔹 Price Action Pivot Zone:

The critical range to monitor for potential trend reversals or continuation is 23,274 - 23,427.

🔹 Support & Resistance Levels:

Support:

Resistance:

Market Outlook

✅ Bullish Scenario: A sustained breakout above 23,427 may attract buying interest, potentially pushing Nifty towards R1 (23,658) and beyond.

❌ Bearish Scenario: If the index slips below 23,274, selling pressure could increase, driving Nifty towards S1 (23,046) or lower.

Disclaimer: This analysis is for educational purposes only. Investors should conduct their own research before making any trading decisions.

Key Levels for the Upcoming Week

🔹 Price Action Pivot Zone:

The critical range to monitor for potential trend reversals or continuation is 23,274 - 23,427.

🔹 Support & Resistance Levels:

Support:

- S1: 23,046

- S2: 22,743

- S3: 22,427

Resistance:

- R1: 23,658

- R2: 23,965

- R3: 24,227

Market Outlook

✅ Bullish Scenario: A sustained breakout above 23,427 may attract buying interest, potentially pushing Nifty towards R1 (23,658) and beyond.

❌ Bearish Scenario: If the index slips below 23,274, selling pressure could increase, driving Nifty towards S1 (23,046) or lower.

Disclaimer: This analysis is for educational purposes only. Investors should conduct their own research before making any trading decisions.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.