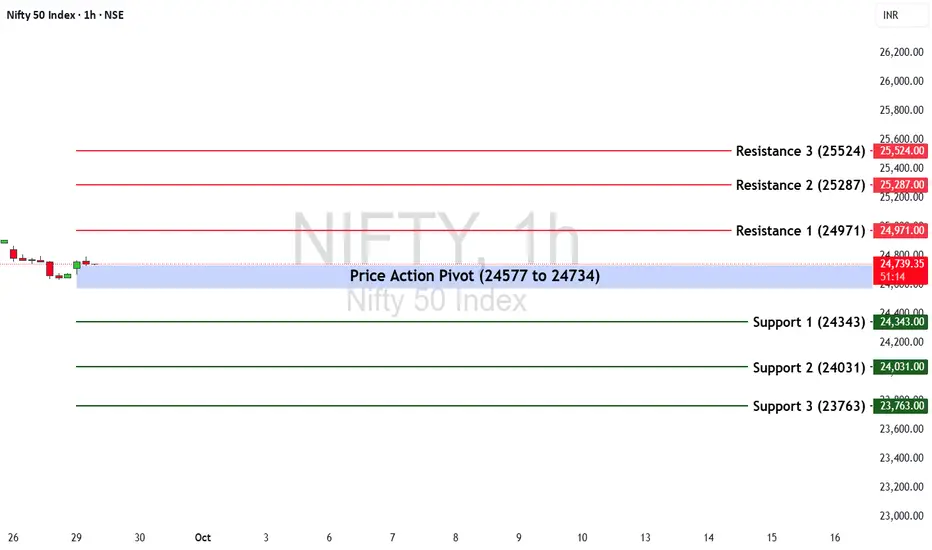

The Nifty 50 ended the week at 24,654.70, closing with a sharp decline of -2.65%.

🔹 Key Levels for the Upcoming Week

📌 Price Action Pivot Zone:

24,577 to 24,734 – This range will act as a crucial decision-making zone for trend continuation or reversal. A breakout from this zone is likely to set the market tone.

Support Levels:

Support 1 (S1): 24,343

Support 2 (S2): 24,031

Support 3 (S3): 23,763

Resistance Levels:

Resistance 1 (R1): 24,971

Resistance 2 (R2): 25,287

Resistance 3 (R3): 25,524

📈 Market Outlook

Bullish Scenario:

If Nifty sustains above the pivot zone high of 24,734, it may witness fresh buying momentum. Upside targets include R1 (24,971), followed by R2 (25,287) and R3 (25,524).

Bearish Scenario:

Failure to hold above the pivot low of 24,577 could invite selling pressure. On the downside, the index may test S1 (24,343), with extended weakness dragging it towards S2 (24,031) and S3 (23,763).

Disclaimer: tinyurl.com/59ypbsrh

🔹 Key Levels for the Upcoming Week

📌 Price Action Pivot Zone:

24,577 to 24,734 – This range will act as a crucial decision-making zone for trend continuation or reversal. A breakout from this zone is likely to set the market tone.

Support Levels:

Support 1 (S1): 24,343

Support 2 (S2): 24,031

Support 3 (S3): 23,763

Resistance Levels:

Resistance 1 (R1): 24,971

Resistance 2 (R2): 25,287

Resistance 3 (R3): 25,524

📈 Market Outlook

Bullish Scenario:

If Nifty sustains above the pivot zone high of 24,734, it may witness fresh buying momentum. Upside targets include R1 (24,971), followed by R2 (25,287) and R3 (25,524).

Bearish Scenario:

Failure to hold above the pivot low of 24,577 could invite selling pressure. On the downside, the index may test S1 (24,343), with extended weakness dragging it towards S2 (24,031) and S3 (23,763).

Disclaimer: tinyurl.com/59ypbsrh

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.