Actionable Trading Framework

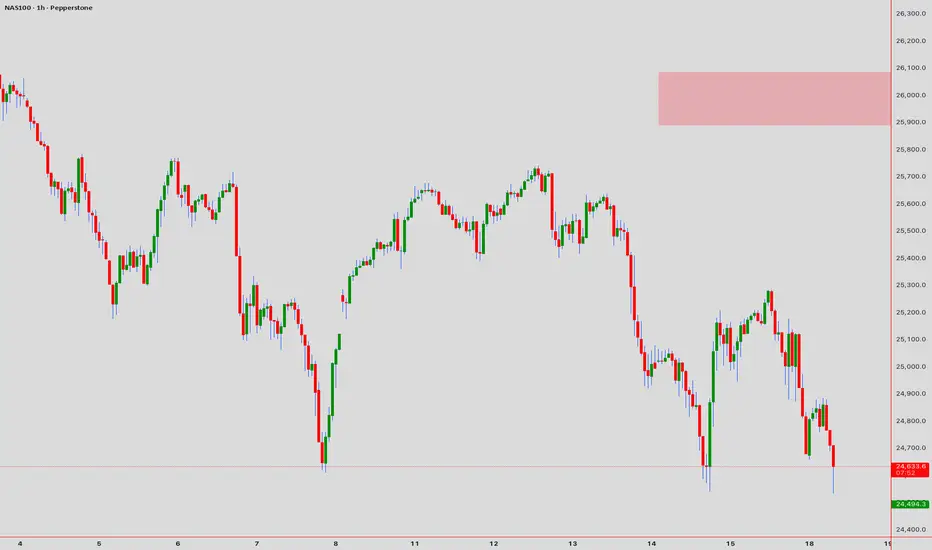

Bullish Scenario (Probability: 60%)

Entry: 24,595-24,620 (consolidation breach confirmation)

Target 1:24,680 (+$62 risk/reward)

Target 2: 24,750 (+$132 profit extension)

Stop Loss: 24,550 (-$45)

Trigger: Break above 24,650 with volume confirmation on 5/15-min charts

Bearish Scenario (Probability: 40%)

Entry: 24,680-24,710 (rejection candle formation)

Target 1: 24,600 (-$80 to +$30 range)

Target 2: 24,520 (-$160 reversal)

Stop Loss: 24,760 (+$50)

Trigger: Failed breakout attempt + RSI divergence on 1-hour chart

Key Technical Confluences

✓ EMA 20/50 Crossover Zone → Dynamic support (1-hour timeframe)

✓ VWAP Alignment → Acts as pivot point at 24,635

✓ Harmonic Pattern → Potential bullish AB=CD completion near current zone

✓ Ichimoku Tenkan-sen → Resistance pressure at 24,705

Execution Rules

1. Entry Confirmation: Engulfing or Pin Bar + Volume Spike on 5-min chart

2. Risk Management: Maximum risk per trade = 1% account size

3. Time Window: Optimal trading 08:00-15:00 UTC+4 (high liquidity period)

4. Exit Protocol: Trail stop at 15-pips after Target 1 achievement

Bullish Scenario (Probability: 60%)

Entry: 24,595-24,620 (consolidation breach confirmation)

Target 1:24,680 (+$62 risk/reward)

Target 2: 24,750 (+$132 profit extension)

Stop Loss: 24,550 (-$45)

Trigger: Break above 24,650 with volume confirmation on 5/15-min charts

Bearish Scenario (Probability: 40%)

Entry: 24,680-24,710 (rejection candle formation)

Target 1: 24,600 (-$80 to +$30 range)

Target 2: 24,520 (-$160 reversal)

Stop Loss: 24,760 (+$50)

Trigger: Failed breakout attempt + RSI divergence on 1-hour chart

Key Technical Confluences

✓ EMA 20/50 Crossover Zone → Dynamic support (1-hour timeframe)

✓ VWAP Alignment → Acts as pivot point at 24,635

✓ Harmonic Pattern → Potential bullish AB=CD completion near current zone

✓ Ichimoku Tenkan-sen → Resistance pressure at 24,705

Execution Rules

1. Entry Confirmation: Engulfing or Pin Bar + Volume Spike on 5-min chart

2. Risk Management: Maximum risk per trade = 1% account size

3. Time Window: Optimal trading 08:00-15:00 UTC+4 (high liquidity period)

4. Exit Protocol: Trail stop at 15-pips after Target 1 achievement

I am nothing @shunya.trade

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

I am nothing @shunya.trade

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.