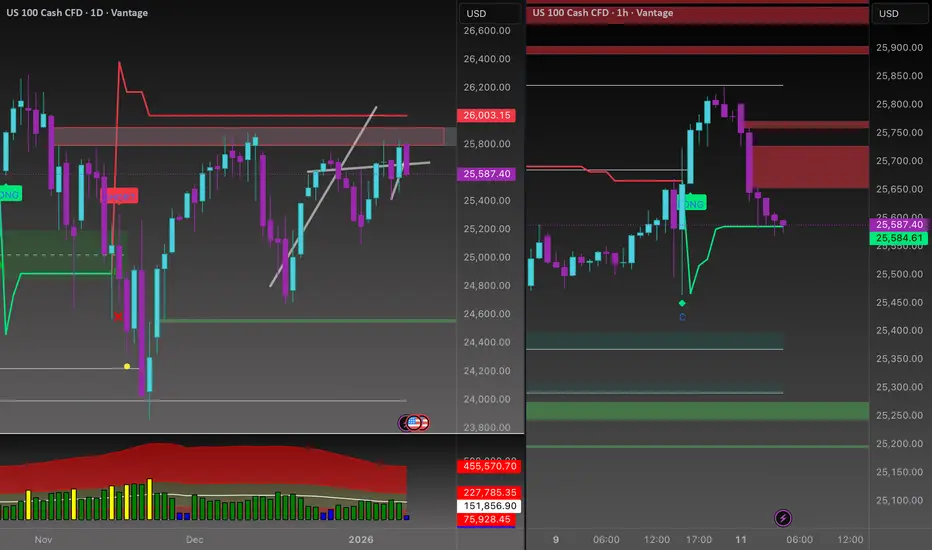

Higher timeframe structure remains distributional, with price sitting in premium territory.

• Daily OG supply active at 25,950 – 26,050

• No daily acceptance above 26,050

• Upside lacks displacement and follow-through

• HTF context favors sell-side positioning

Above here is not trend continuation, it’s liquidity hunting.

• 1H OG supply: 25,720 – 25,820

• Strong rejection and structure breakdown below 25,720

• Bullish move shows exhaustion, not accumulation

• Sell-side liquidity stacked below 25,500

This is how smart money sells into strength.

Primary Bias: Bearish below 25,720

Expectation:

• Pullbacks into 25,650 – 25,750 are sell opportunities

• Target: liquidity sweep toward 25,400 – 25,300

• Extended downside opens 25,150 if momentum accelerates

Invalidation / Cancellation:

• Clean 1H close and acceptance above 25,820

• Daily close above 26,050 cancels the sell idea completely

Until that happens, rallies are for selling, not chasing.

İlgili yayınlar

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.