GEX + Price Structure Align for Breakout or Breakdown 🔸

🧠 GEX Levels & Options Sentiment (as of July 15, 2025)

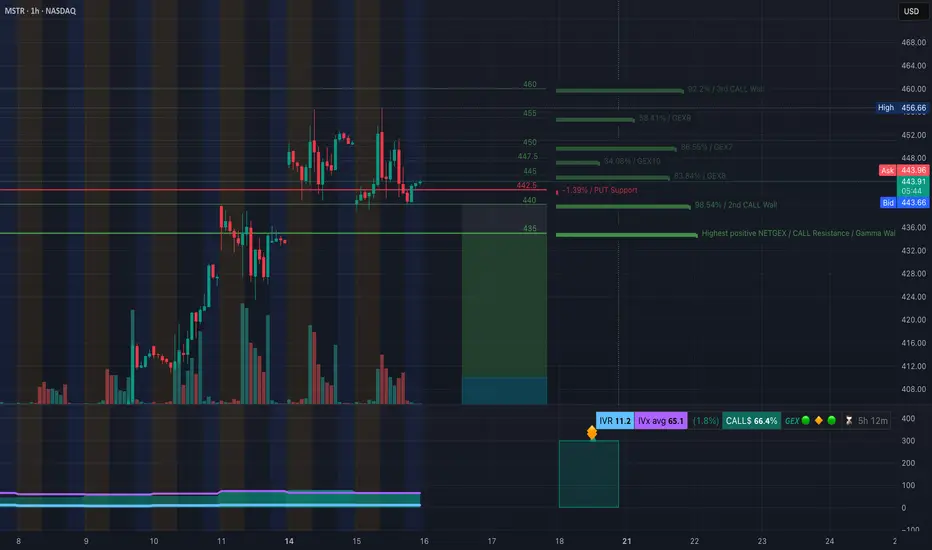

* ⚠️ Key Call Resistance Levels: • $460 (3rd Call Wall, 92.2%) • $455 (58.41%) • $447.5 (GEX10) • $444.5 (GEX7) – overhead friction

* PUT Support Levels: • $442.5 (near current price) • $435 (Gamma Wall: highest positive NET GEX)

* Support Structure: Strong GEX support at $435

* Current IVR: 11.2 (extremely low)

* IVx Avg: 65.1

* Call Flow: 🚀 66.4% Call $ flow — strong bullish bias

* GEX Directional Lean: Bullish-neutral, but decision point is here

💡 Option Strategy Ideas:

* If MSTR holds above $444 → Target $447.5 and $455 • Play: Buy 445c or 450c (weekly expiry) • Risk: < $442.50 closes

* If MSTR breaks $442 → Watch for slide to $435 • Play: Buy 440p or 435p • Risk: Tight stop above $444.50 retest

📉 1H Chart Technical Analysis & Trade Plan

* Market Structure: • Bullish channel still intact, but CHoCH just printed below $443 • Multiple Breaks of Structure (BOS) above $444 and $448.5 • Supply zone between $445–$447 acting as resistance • Price is testing demand around $440–$442.5 (important junction)

* Trendlines: Price currently bouncing along the lower channel boundary

* Demand Zone: $428–$435 is the major support base

* If CHoCH holds and price fails to reclaim $445 → we could see a deeper retrace into $435

* If bulls reclaim and hold $445 → breakout toward $447.5 → $455 is likely

🔁 Intraday Scenarios for Tuesday (July 16):

* Scalp Long above $445.5 • Target: $447.5, $455 • Stop: below $443

* Scalp Put below $442 • Target: $435 • Stop: Above $444.50

🔚 Final Thoughts:

MSTR is at a make-or-break level, sandwiched between a GEX friction zone and key price structure support. Keep risk tight — this setup can move quickly.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and trade responsibly.

🧠 GEX Levels & Options Sentiment (as of July 15, 2025)

* ⚠️ Key Call Resistance Levels: • $460 (3rd Call Wall, 92.2%) • $455 (58.41%) • $447.5 (GEX10) • $444.5 (GEX7) – overhead friction

* PUT Support Levels: • $442.5 (near current price) • $435 (Gamma Wall: highest positive NET GEX)

* Support Structure: Strong GEX support at $435

* Current IVR: 11.2 (extremely low)

* IVx Avg: 65.1

* Call Flow: 🚀 66.4% Call $ flow — strong bullish bias

* GEX Directional Lean: Bullish-neutral, but decision point is here

💡 Option Strategy Ideas:

* If MSTR holds above $444 → Target $447.5 and $455 • Play: Buy 445c or 450c (weekly expiry) • Risk: < $442.50 closes

* If MSTR breaks $442 → Watch for slide to $435 • Play: Buy 440p or 435p • Risk: Tight stop above $444.50 retest

📉 1H Chart Technical Analysis & Trade Plan

* Market Structure: • Bullish channel still intact, but CHoCH just printed below $443 • Multiple Breaks of Structure (BOS) above $444 and $448.5 • Supply zone between $445–$447 acting as resistance • Price is testing demand around $440–$442.5 (important junction)

* Trendlines: Price currently bouncing along the lower channel boundary

* Demand Zone: $428–$435 is the major support base

* If CHoCH holds and price fails to reclaim $445 → we could see a deeper retrace into $435

* If bulls reclaim and hold $445 → breakout toward $447.5 → $455 is likely

🔁 Intraday Scenarios for Tuesday (July 16):

* Scalp Long above $445.5 • Target: $447.5, $455 • Stop: below $443

* Scalp Put below $442 • Target: $435 • Stop: Above $444.50

🔚 Final Thoughts:

MSTR is at a make-or-break level, sandwiched between a GEX friction zone and key price structure support. Keep risk tight — this setup can move quickly.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and trade responsibly.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.