The 55 EMA is widely watched by institutions and swing traders as a medium-term trend gauge.

When price tests this line after a strong run or selloff:

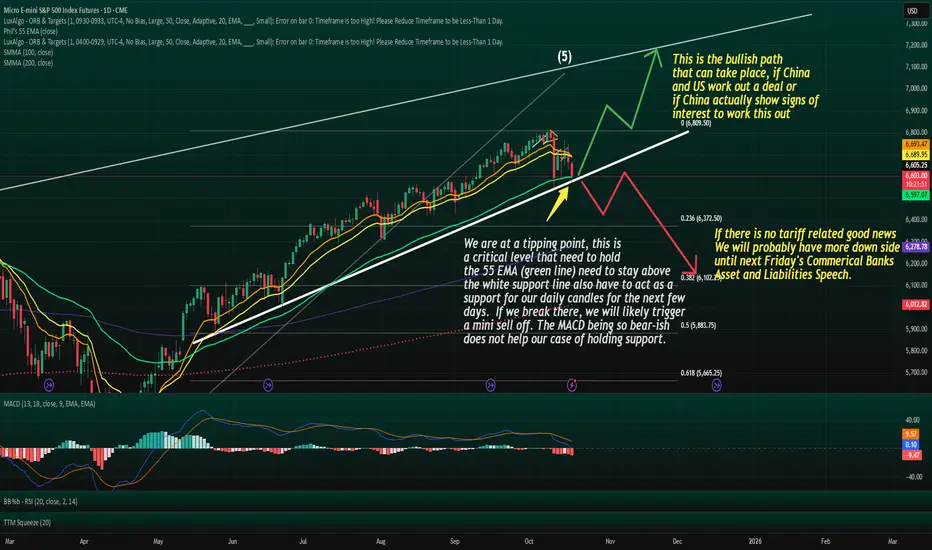

Holding above often leads to trend continuation or strong bounce as seen in the path on my chart.

Losing it convincingly tends to signal a deeper correction or even a trend reversal.

Right now, ES is coiling around the 55EMA, which is the kind of tension point where volatility can explode.

Lower Trend Line = Structural Support

The fact that the EMA test with the lower trend line can adds weight to the downward movement.

When a support trend line and EMA level line up, it becomes a confluence zone meaning breakouts or breakdowns from here are often decisive.

A breakdown of this confluence could open the door to:

A larger corrective Wave A or C leg down.

Possibly a multi-month correction into year end if macro news doesn’t provide support.

Fundamental Catalyst Is Lurking

Tariff or trade-deal headlines can be the kind of fundamental catalyst that aligns perfectly with this technical pressure point.

That alignment is classic in Elliott Wave:

The technicals create the setup.

The news provides the spark.

The breakout or breakdown is fast and aggressive.

⚠️ This is why these zones are dangerous for complacent positioning both bulls and bears can get steamrolled when the move starts.

Two Clear Scenarios

Bullish: candle hold above 55 EMA + trend line then bounce toward upper channel, possibly Wave B or new Wave 3

Bearish: clean daily close below support with 55 EMA dropping below can trigger a multi week(s) correction, potential acceleration downward if no positive news

Bull case → initial target near upper trendline / Fib extension levels.

Bear case → retest of previous swing lows or even 0.618 retrace of the entire rally.

Risk Management Matters Most Here

This is the kind of zone where:

Stops should be clearly defined — not “mental.”

Position size should respect that a big move can be triggered fast.

Targets should be realistic, because reactions off the 55 EMA can be sharp.

“When technicals and fundamentals line up, the market doesn’t tiptoe, it sprints.”

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.