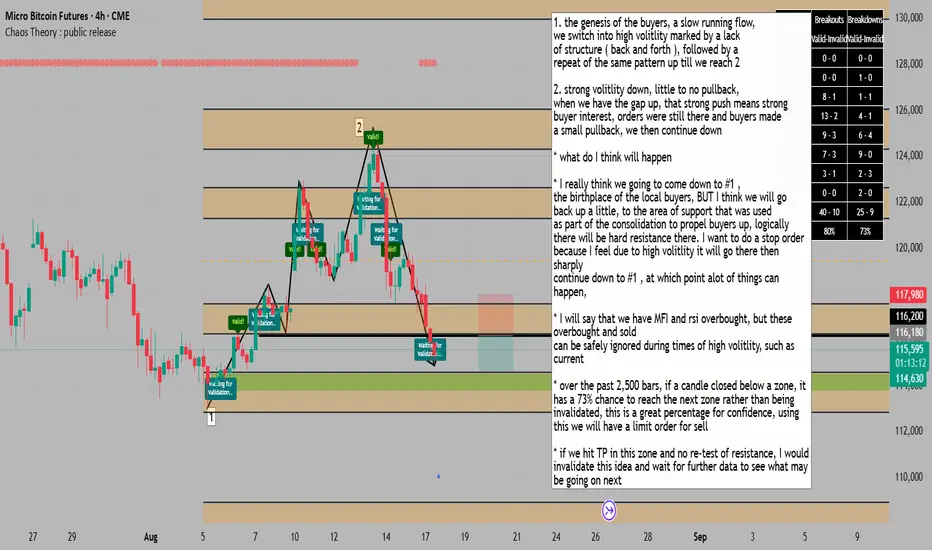

1. the genesis of the buyers, a slow running flow,

we switch into high volitlity marked by a lack

of structure ( back and forth ), followed by a

repeat of the same pattern up till we reach 2

2. strong volitlity down, little to no pullback,

when we have the gap up, that strong push means strong

buyer interest, orders were still there and buyers made

a small pullback, we then continue down

* what do I think will happen

* I really think we going to come down to #1 ,

the birthplace of the local buyers, BUT I think we will go

back up a little, to the area of support that was used

as part of the consolidation to propel buyers up, logically

there will be hard resistance there. I want to do a stop order

because I feel due to high volitlity it will go there then sharply

continue down to #1 , at which point alot of things can happen,

* I will say that we have MFI and rsi overbought, but these overbought and sold

can be safely ignored during times of high volitlity, such as current

* over the past 2,500 bars, if a candle closed below a zone, it has a 73% chance to reach the next zone rather than being invalidated, this is a great percentage for confidence, using this we will have a limit order for sell

* if we hit TP in this zone and no re-test of resistance, I would invalidate this idea and wait for further data to see what may be going on next

we switch into high volitlity marked by a lack

of structure ( back and forth ), followed by a

repeat of the same pattern up till we reach 2

2. strong volitlity down, little to no pullback,

when we have the gap up, that strong push means strong

buyer interest, orders were still there and buyers made

a small pullback, we then continue down

* what do I think will happen

* I really think we going to come down to #1 ,

the birthplace of the local buyers, BUT I think we will go

back up a little, to the area of support that was used

as part of the consolidation to propel buyers up, logically

there will be hard resistance there. I want to do a stop order

because I feel due to high volitlity it will go there then sharply

continue down to #1 , at which point alot of things can happen,

* I will say that we have MFI and rsi overbought, but these overbought and sold

can be safely ignored during times of high volitlity, such as current

* over the past 2,500 bars, if a candle closed below a zone, it has a 73% chance to reach the next zone rather than being invalidated, this is a great percentage for confidence, using this we will have a limit order for sell

* if we hit TP in this zone and no re-test of resistance, I would invalidate this idea and wait for further data to see what may be going on next

Not

initially I said stop order accidently, I meant a limit order, if you notice I did say limit order the second time when I mentioned the order type, which would activate during the pullback and give a superior RR , which would have workedfor trading mentorship and community, message me on telegram : jacesabr_real

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

for trading mentorship and community, message me on telegram : jacesabr_real

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.