## MARA Technical Analysis & Market Outlook

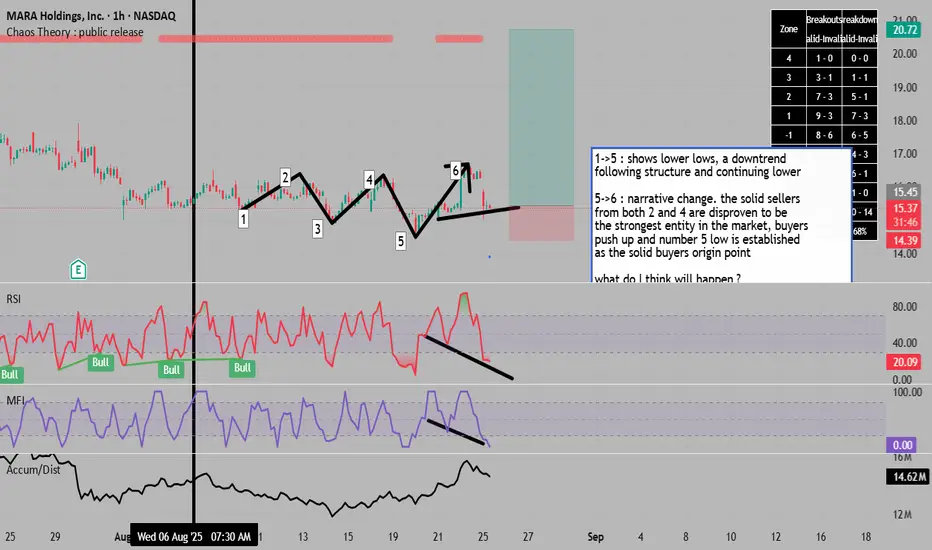

### **Elliott Wave Structure (1→5)**

The decline from wave 1 to 5 traced a clear five-wave impulsive move lower, establishing a downtrend with progressively lower lows. This bearish sequence bottomed around $10, marking the completion of the corrective phase.

### **Market Structure Shift (5→6)**

Wave 5 marked a critical inflection point. The subsequent rally to wave 6 (~$21) invalidated the bearish control established at waves 2 and 4, confirming that selling pressure had been exhausted. This pivot established the $10-14 zone as the **"smart money" accumulation area** - a level now being retested.

### **Current Setup at $15.47**

We've returned to this proven demand zone with multiple confluence factors:

**Technical Indicators:**

- **Inside candle formation** after aggressive selling - classic equilibrium pattern suggesting seller exhaustion

- **Bullish divergence** on RSI (currently 36.76) and MFI - price making lower lows while momentum indicators show higher lows

- **Oversold conditions** across multiple timeframes with RSI in the 30s

- Testing the **critical $14-15 support zone** that sparked the previous 100%+ rally

**Market Context:**

- Analysts maintain **$22.95 average price target** (47% upside) with targets ranging to $39

- 8 Buy ratings vs 0 Sell ratings from Wall Street analysts

- Bitcoin correlation remains strong, with BTC targeting $140,000 by year-end per Elliott Wave analysis

- Institutional accumulation continuing via ETFs despite recent price weakness

### **Trade Thesis**

The convergence of oversold technicals, bullish divergence, and a retest of proven support creates an asymmetric risk/reward opportunity. The inside candle represents the market catching its breath before the next directional move. Given that:

1. Previous buyers defended this zone aggressively (wave 5→6 move)

2. Momentum indicators are flashing oversold with positive divergence

3. Analyst consensus sees 40-50% upside to fair value

4. Bitcoin's broader trend remains intact with $140k targets

**The probability favors a bounce from current levels back toward $20-23 initial targets, with $14 as a clear stop-loss level.**

### **Risk Management**

- **Entry Zone**: $15-16

- **Stop Loss**: Below $14 (wave 5 low)

- **Initial Target**: $20-23 (analyst consensus range)

- **Secondary Target**: $25+ (if Bitcoin reaches $140k projections)

- **Risk/Reward**: ~1:3 minimum

The market has shown its hand - buyers step in aggressively at these levels. Until proven otherwise, this zone should act as a springboard for the next leg higher.

### **Elliott Wave Structure (1→5)**

The decline from wave 1 to 5 traced a clear five-wave impulsive move lower, establishing a downtrend with progressively lower lows. This bearish sequence bottomed around $10, marking the completion of the corrective phase.

### **Market Structure Shift (5→6)**

Wave 5 marked a critical inflection point. The subsequent rally to wave 6 (~$21) invalidated the bearish control established at waves 2 and 4, confirming that selling pressure had been exhausted. This pivot established the $10-14 zone as the **"smart money" accumulation area** - a level now being retested.

### **Current Setup at $15.47**

We've returned to this proven demand zone with multiple confluence factors:

**Technical Indicators:**

- **Inside candle formation** after aggressive selling - classic equilibrium pattern suggesting seller exhaustion

- **Bullish divergence** on RSI (currently 36.76) and MFI - price making lower lows while momentum indicators show higher lows

- **Oversold conditions** across multiple timeframes with RSI in the 30s

- Testing the **critical $14-15 support zone** that sparked the previous 100%+ rally

**Market Context:**

- Analysts maintain **$22.95 average price target** (47% upside) with targets ranging to $39

- 8 Buy ratings vs 0 Sell ratings from Wall Street analysts

- Bitcoin correlation remains strong, with BTC targeting $140,000 by year-end per Elliott Wave analysis

- Institutional accumulation continuing via ETFs despite recent price weakness

### **Trade Thesis**

The convergence of oversold technicals, bullish divergence, and a retest of proven support creates an asymmetric risk/reward opportunity. The inside candle represents the market catching its breath before the next directional move. Given that:

1. Previous buyers defended this zone aggressively (wave 5→6 move)

2. Momentum indicators are flashing oversold with positive divergence

3. Analyst consensus sees 40-50% upside to fair value

4. Bitcoin's broader trend remains intact with $140k targets

**The probability favors a bounce from current levels back toward $20-23 initial targets, with $14 as a clear stop-loss level.**

### **Risk Management**

- **Entry Zone**: $15-16

- **Stop Loss**: Below $14 (wave 5 low)

- **Initial Target**: $20-23 (analyst consensus range)

- **Secondary Target**: $25+ (if Bitcoin reaches $140k projections)

- **Risk/Reward**: ~1:3 minimum

The market has shown its hand - buyers step in aggressively at these levels. Until proven otherwise, this zone should act as a springboard for the next leg higher.

all my paid ( pro ) scripts can be obtained for a low price of 19.99 / month at : whop.com/sabr-pro-tools/access-to-all-pro-tools/

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

all my paid ( pro ) scripts can be obtained for a low price of 19.99 / month at : whop.com/sabr-pro-tools/access-to-all-pro-tools/

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.