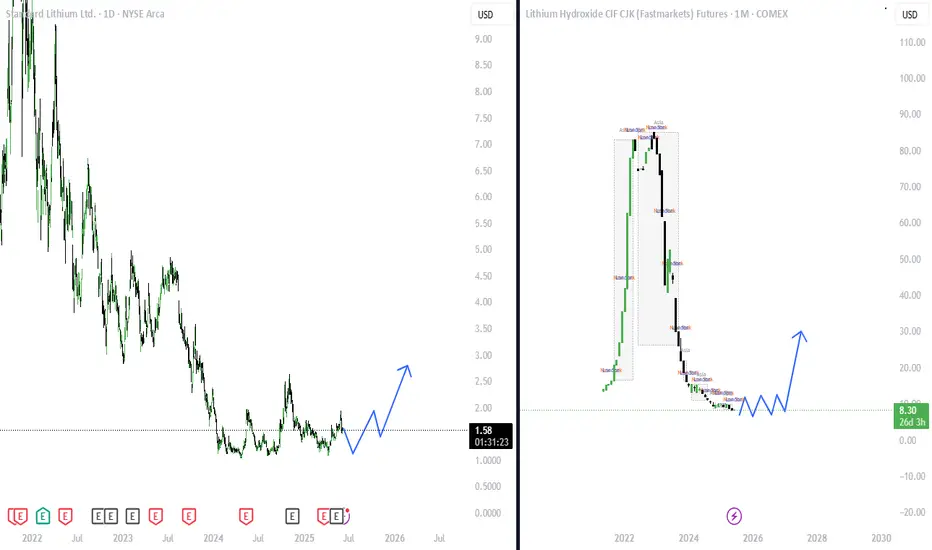

Why Are Lithium Prices at Multi-Year Lows?

1. Oversupply: Between 2022 and 2024, global lithium production surged by over 35%, outpacing demand growth of approximately 30%. This imbalance led to a surplus of around 154,000 tonnes in 2024.

2. Slower EV Adoption: The anticipated rapid growth in EV sales, especially in China, did not materialize as expected. Factors such as reduced government subsidies and economic uncertainties contributed to this slowdown.

3. Inventory Build-Up: Battery manufacturers and cathode producers accumulated significant inventories, reducing immediate demand for new lithium supplies.

4. Increased Production Capacity: New lithium projects, particularly in Australia and Africa, added to the global supply, exacerbating the oversupply situation.

5. Cheap but not yet proven Sodium batteries.

Potential for Price Recovery

Despite the current downturn, several factors suggest a potential rebound in lithium prices:

1. Projected Supply Deficit: Analysts forecast that the lithium market could shift from a surplus to a deficit as early as 2026, driven by sustained demand growth and potential supply constraints.

2. Ongoing Demand from EVs and Energy Storage: The global push for electrification and renewable energy storage continues to underpin long-term lithium demand.

3. Industry Consolidation: Major players like Rio Tinto are investing heavily in lithium assets, indicating confidence in the metal's long-term value.

Lithium Price Forecast

According to projections:

2025: Approximately $11,000 per tonne

2026: Around $13,250 per tonne

2027: Approximately $15,646 per tonne

2028: Around $17,077 per tonne

-Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Stock prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not personally liable for your own losses, this is not financial advise.

1. Oversupply: Between 2022 and 2024, global lithium production surged by over 35%, outpacing demand growth of approximately 30%. This imbalance led to a surplus of around 154,000 tonnes in 2024.

2. Slower EV Adoption: The anticipated rapid growth in EV sales, especially in China, did not materialize as expected. Factors such as reduced government subsidies and economic uncertainties contributed to this slowdown.

3. Inventory Build-Up: Battery manufacturers and cathode producers accumulated significant inventories, reducing immediate demand for new lithium supplies.

4. Increased Production Capacity: New lithium projects, particularly in Australia and Africa, added to the global supply, exacerbating the oversupply situation.

5. Cheap but not yet proven Sodium batteries.

Potential for Price Recovery

Despite the current downturn, several factors suggest a potential rebound in lithium prices:

1. Projected Supply Deficit: Analysts forecast that the lithium market could shift from a surplus to a deficit as early as 2026, driven by sustained demand growth and potential supply constraints.

2. Ongoing Demand from EVs and Energy Storage: The global push for electrification and renewable energy storage continues to underpin long-term lithium demand.

3. Industry Consolidation: Major players like Rio Tinto are investing heavily in lithium assets, indicating confidence in the metal's long-term value.

Lithium Price Forecast

According to projections:

2025: Approximately $11,000 per tonne

2026: Around $13,250 per tonne

2027: Approximately $15,646 per tonne

2028: Around $17,077 per tonne

-Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Stock prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not personally liable for your own losses, this is not financial advise.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.