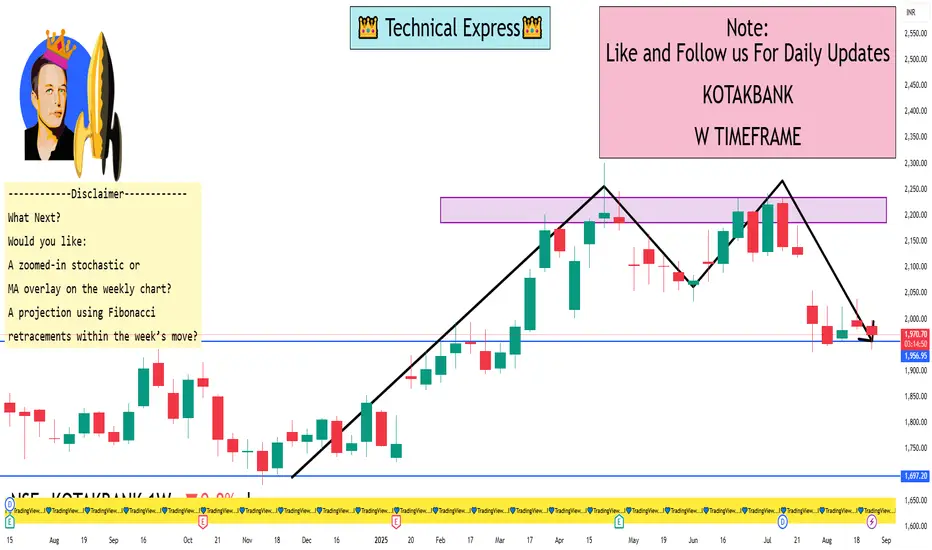

Weekly Technical Levels & Analysis

Pivot-Based Levels (from TopStockResearch)

Weekly Support Zones (Standard pivots):

S1: ₹1,964.87

S2: ₹1,943.13

S3: ₹1,906.07

Weekly Resistance Zones:

R1: ₹2,001.93

R2: ₹2,060.73

R3: ₹2,082.47

These pivot levels often act as short-term barriers and support and can help anticipate price behavior within the current weekly range.

Elliott Wave Analysis (from FXStreet)

The stock appears to be beginning Wave 3 in an Elliott Wave count—typically the strongest impulse phase.

The invalidating level for this bullish count is pegged at ₹1,681. As long as the price stays above this, the bullish structure remains valid.

This suggests strong upward potential in the medium term.

Pivot-Based Levels (from TopStockResearch)

Weekly Support Zones (Standard pivots):

S1: ₹1,964.87

S2: ₹1,943.13

S3: ₹1,906.07

Weekly Resistance Zones:

R1: ₹2,001.93

R2: ₹2,060.73

R3: ₹2,082.47

These pivot levels often act as short-term barriers and support and can help anticipate price behavior within the current weekly range.

Elliott Wave Analysis (from FXStreet)

The stock appears to be beginning Wave 3 in an Elliott Wave count—typically the strongest impulse phase.

The invalidating level for this bullish count is pegged at ₹1,681. As long as the price stays above this, the bullish structure remains valid.

This suggests strong upward potential in the medium term.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

İlgili yayınlar

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

İlgili yayınlar

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.