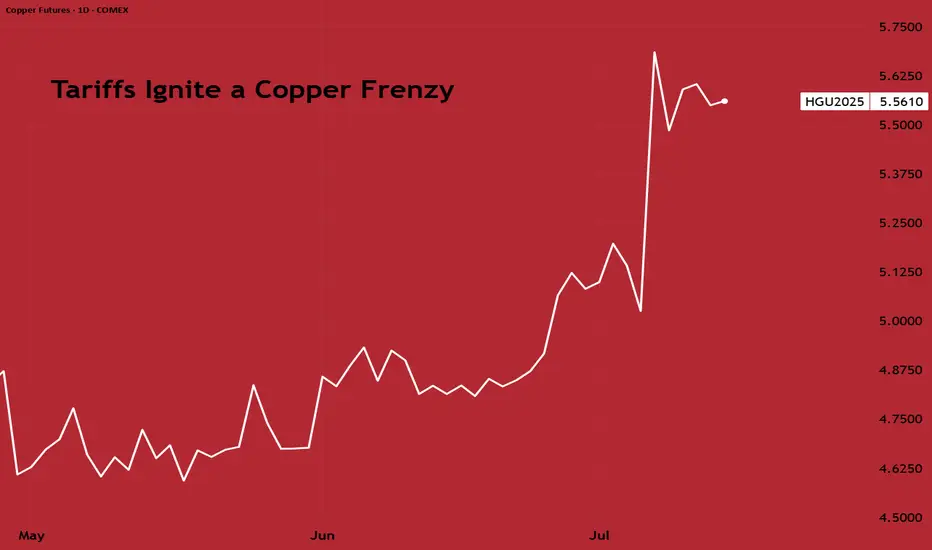

COMEX copper has surged to a record premium over London Metal Exchange (LME) copper over the past few weeks, reflecting a lucrative arbitrage as traders rush metal into the U.S. ahead of looming import tariffs.

President Donald Trump’s announcement of a 50% tariff on U.S. copper imports (effective August 1, 2025) has dramatically disrupted the global copper market. U.S. futures are now trading at a significant premium of $2,600 per metric ton over LME prices, pulling physical copper into the US from around the world.

As a result, inventories have ballooned in U.S. warehouses while declining sharply elsewhere. COMEX (CME) stockpiles have surged to exceed the combined copper inventories of LME and SHFE (Shanghai), indicating massive stockpiling in the U.S.

Correspondingly, LME warehouse stocks have fallen to multi-year lows, fuelling a steep backwardation (near-term prices trading above far-dated futures) as available supply in London shrinks. LME–tracked inventories have declined by roughly 60% so far in 2025.

This tariff-induced distortion is also evident in trade flows. Analysts estimate the U.S. imported around 881,000 tons of copper in the first half of 2025, roughly double its underlying consumption, as buyers rushed to secure cheaper metal before tariffs hit.

Once the tariff is implemented and these stockpiles start being utilised, U.S. imports are expected to plunge and weigh on global copper prices later this year.

Going forward, clarity on the tariff’s scope regarding any exemptions for key suppliers like Chile or Canada will determine if COMEX Copper sustains a large premium.

CHINA'S PIVOT FROM HOARDING TO DRAINING

While the U.S. has been hoarding copper, demand in China, the world’s largest consumer, presents a mixed picture. On the one hand, China’s property construction sector remains sluggish, and manufacturing activity has only tentatively improved.

Earlier in the year, Chinese copper inventories surged to multi-year highs; an unusual build likely driven by weak consumption and precautionary stockpiling. However, this trend has since reversed sharply. Chinese copper stockpiles peaked around 377,000 mt in March before plunging to 126,000 mt by end-June.

This drawdown suggests that, despite macroeconomic headwinds, China’s copper usage remained resilient. Grid companies and manufacturers continued buying copper at high levels, even as consumer sectors slowed.

Copper demand in China is coming from strategic industries: State Grid investment soared nearly 20% YoY until May 2025, and manufacturing of electric vehicles and appliances remains a bright spot.

Owing to reduced demand in construction, though, the net effect for near-term demand remains somewhat on the softer side, but it is still far from collapsing.

Any further government stimulus for infrastructure or housing in H2 2025 could quickly translate into a bump in copper demand, given the low inventories now in China.

LONGER-TERM UPSIDE THROUGH SUPPLY CHALLENGES

Beyond the immediate cross-currents, the medium-to-long-term outlook for copper is fundamentally bullish, owing to the significant constraints on the supply side.

Many of the world’s largest copper mines are ageing, with declining ore grades and operational challenges.

In Chile (the top copper-producing country), Codelco’s output hit a 25-year low in 2023 amid falling grades and project delays. The state-owned giant is striving to boost production in 2025, but first-quarter 2025 output was essentially flat (+0.3% YoY), and was hampered by unforeseen disruptions like heavy rains and a nationwide power blackout.

Similarly, Anglo American, another major producer, has warned of lower production. Anglo expects its copper output to drop to 690–750 thousand tons in 2025, down from 773k in 2024, due to lower ore grades and water restrictions at its Chilean operations.

Due to the massive wedge between demand and supply dynamics, analysts have predicted the copper market to slip into a substantial deficit next year, even sans tariffs.

The recent tariff saga, creating all the noise, would exacerbate near-term tightness, and would lead to U.S. consumers drawing down global supply. This sets the stage for sharper shortages later.

Supply from recycling is also expected to take a hit due to the trade friction between China and US.

In response to the tariffs, China could cut back imports of US scrap copper. This would, in effect, reduce China's exports of refined copper, with less refined copper entering the global supply consequently.

This further strengthens the case for prolonged upward price pressure.

HYPOTHETICAL TRADE SET-UP:

For investors, the divergent short- and long-term forces in copper open several strategy avenues. In the very near term, prices may remain volatile or even pull back once U.S. imports pause, with others having increased access to the metal.

However, any such dip would present a buying opportunity given copper’s strong fundamentals. A straightforward bullish strategy is to establish a long position in copper futures, taking advantage of any weakness.

For example, one could go long the CME Copper futures (March 2026 expiry) to express a positive view on copper into next year.

Open interest for this contract lies just under 30,000, with volume as on 11/Jul clocking 3095.

The hypothesis is that after a period of consolidation, copper prices will resume an uptrend as the market shifts focus from temporary inventory builds to the looming supply deficit. Indeed, the term structure is also signalling tighter conditions down the line; while nearby copper prices spiked on the tariff news, longer-dated futures have also firmed as traders anticipate future scarcity.

With that in mind, a possible trade setup is outlined below:

● Entry: $5.68 per pound

● Target: $6.20 per pound

● Stop Loss: $5.37 per pound

● Profit at Target: $13,000 ((6.20 – 5.68) = 0.52 x 25,000 pounds/contract)

● Loss at Stop: $ 7,750 ((5.37 – 5.68) = -0.31 x 25,000 pounds/contract)

● Reward-to-Risk: 1.7x

The same view can also be expressed through CME Micro Copper futures, which offer smaller notional positions and more flexibility. Each Micro contract is priced in USD per pound and represents 2,500 pounds of copper, compared to 25,000 pounds for the standard contract.

As history shows, the “electrifying metal” tends to reward those who can weather short-term volatility in pursuit of its long-term uptrend.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme.

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

President Donald Trump’s announcement of a 50% tariff on U.S. copper imports (effective August 1, 2025) has dramatically disrupted the global copper market. U.S. futures are now trading at a significant premium of $2,600 per metric ton over LME prices, pulling physical copper into the US from around the world.

As a result, inventories have ballooned in U.S. warehouses while declining sharply elsewhere. COMEX (CME) stockpiles have surged to exceed the combined copper inventories of LME and SHFE (Shanghai), indicating massive stockpiling in the U.S.

Correspondingly, LME warehouse stocks have fallen to multi-year lows, fuelling a steep backwardation (near-term prices trading above far-dated futures) as available supply in London shrinks. LME–tracked inventories have declined by roughly 60% so far in 2025.

Source: Bloomberg

This tariff-induced distortion is also evident in trade flows. Analysts estimate the U.S. imported around 881,000 tons of copper in the first half of 2025, roughly double its underlying consumption, as buyers rushed to secure cheaper metal before tariffs hit.

Once the tariff is implemented and these stockpiles start being utilised, U.S. imports are expected to plunge and weigh on global copper prices later this year.

Going forward, clarity on the tariff’s scope regarding any exemptions for key suppliers like Chile or Canada will determine if COMEX Copper sustains a large premium.

CHINA'S PIVOT FROM HOARDING TO DRAINING

While the U.S. has been hoarding copper, demand in China, the world’s largest consumer, presents a mixed picture. On the one hand, China’s property construction sector remains sluggish, and manufacturing activity has only tentatively improved.

Earlier in the year, Chinese copper inventories surged to multi-year highs; an unusual build likely driven by weak consumption and precautionary stockpiling. However, this trend has since reversed sharply. Chinese copper stockpiles peaked around 377,000 mt in March before plunging to 126,000 mt by end-June.

This drawdown suggests that, despite macroeconomic headwinds, China’s copper usage remained resilient. Grid companies and manufacturers continued buying copper at high levels, even as consumer sectors slowed.

Source: Crux Investor

Copper demand in China is coming from strategic industries: State Grid investment soared nearly 20% YoY until May 2025, and manufacturing of electric vehicles and appliances remains a bright spot.

Owing to reduced demand in construction, though, the net effect for near-term demand remains somewhat on the softer side, but it is still far from collapsing.

Any further government stimulus for infrastructure or housing in H2 2025 could quickly translate into a bump in copper demand, given the low inventories now in China.

LONGER-TERM UPSIDE THROUGH SUPPLY CHALLENGES

Beyond the immediate cross-currents, the medium-to-long-term outlook for copper is fundamentally bullish, owing to the significant constraints on the supply side.

Many of the world’s largest copper mines are ageing, with declining ore grades and operational challenges.

In Chile (the top copper-producing country), Codelco’s output hit a 25-year low in 2023 amid falling grades and project delays. The state-owned giant is striving to boost production in 2025, but first-quarter 2025 output was essentially flat (+0.3% YoY), and was hampered by unforeseen disruptions like heavy rains and a nationwide power blackout.

Similarly, Anglo American, another major producer, has warned of lower production. Anglo expects its copper output to drop to 690–750 thousand tons in 2025, down from 773k in 2024, due to lower ore grades and water restrictions at its Chilean operations.

Due to the massive wedge between demand and supply dynamics, analysts have predicted the copper market to slip into a substantial deficit next year, even sans tariffs.

The recent tariff saga, creating all the noise, would exacerbate near-term tightness, and would lead to U.S. consumers drawing down global supply. This sets the stage for sharper shortages later.

Supply from recycling is also expected to take a hit due to the trade friction between China and US.

Source: Bloomberg

In response to the tariffs, China could cut back imports of US scrap copper. This would, in effect, reduce China's exports of refined copper, with less refined copper entering the global supply consequently.

This further strengthens the case for prolonged upward price pressure.

HYPOTHETICAL TRADE SET-UP:

For investors, the divergent short- and long-term forces in copper open several strategy avenues. In the very near term, prices may remain volatile or even pull back once U.S. imports pause, with others having increased access to the metal.

However, any such dip would present a buying opportunity given copper’s strong fundamentals. A straightforward bullish strategy is to establish a long position in copper futures, taking advantage of any weakness.

For example, one could go long the CME Copper futures (March 2026 expiry) to express a positive view on copper into next year.

Source: CME QuikStrike

Open interest for this contract lies just under 30,000, with volume as on 11/Jul clocking 3095.

The hypothesis is that after a period of consolidation, copper prices will resume an uptrend as the market shifts focus from temporary inventory builds to the looming supply deficit. Indeed, the term structure is also signalling tighter conditions down the line; while nearby copper prices spiked on the tariff news, longer-dated futures have also firmed as traders anticipate future scarcity.

Source: CME QuikStrike

With that in mind, a possible trade setup is outlined below:

● Entry: $5.68 per pound

● Target: $6.20 per pound

● Stop Loss: $5.37 per pound

● Profit at Target: $13,000 ((6.20 – 5.68) = 0.52 x 25,000 pounds/contract)

● Loss at Stop: $ 7,750 ((5.37 – 5.68) = -0.31 x 25,000 pounds/contract)

● Reward-to-Risk: 1.7x

The same view can also be expressed through CME Micro Copper futures, which offer smaller notional positions and more flexibility. Each Micro contract is priced in USD per pound and represents 2,500 pounds of copper, compared to 25,000 pounds for the standard contract.

As history shows, the “electrifying metal” tends to reward those who can weather short-term volatility in pursuit of its long-term uptrend.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme.

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

Full Disclaimer - linktr.ee/mintfinance

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

Full Disclaimer - linktr.ee/mintfinance

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.