🔶 1. Understanding Liquidity in the Market

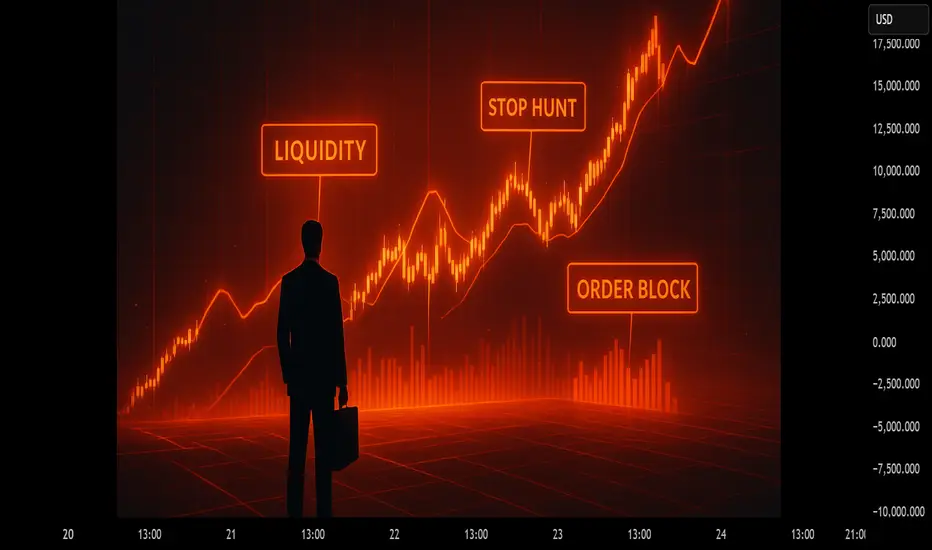

Liquidity represents the orders resting above or below obvious price levels — mainly stop-losses and pending orders placed by retail traders.

In simple terms, where you see equal highs, equal lows, or strong swing points, that’s where liquidity pools exist.

On Gold (XAUUSD), because of its volatility, liquidity often accumulates near:

Double tops or double bottoms.

Previous day highs/lows.

Fair value gaps (imbalances).

Psychological round levels like $2300, $2350, $2400, etc.

These zones attract both buyers and sellers — and that’s exactly where Smart Money (institutional traders) aims to act.

🔶 2. What Smart Money Actually Does

Smart Money doesn’t follow retail moves — it creates them.

When price consolidates and retail traders position themselves early, institutions push price beyond these zones to:

Trigger retail stop losses.

Fill their own large institutional orders at better prices.

Remove weak hands from the market.

This process is called a Liquidity Hunt or Stop Hunt.

It’s not manipulation in a malicious sense — it’s simply how large players execute size efficiently in a decentralized market.

🔶 3. The Classic Gold Liquidity Hunt Pattern

Let’s break down a typical Smart Money setup on XAUUSD:

Step 1:

Price builds equal highs (or equal lows) — retail traders see it as a breakout zone.

Step 2:

Institutions push price slightly beyond that area, creating a false breakout.

Stop-losses of early traders are triggered — this is the liquidity grab.

Step 3:

Immediately after the sweep, structure shifts (Change of Character / CHoCH).

This confirms that Smart Money has completed its collection phase and is now ready to move price in the intended direction.

Step 4:

Price often retraces back into the order block or fair value gap left behind by displacement.

This is where the high-probability entry lies — the Smart Money entry point.

🔶 4. Why Gold (XAUUSD) Shows This So Clearly

Gold is one of the most liquid and manipulated markets on the planet — ideal for studying Smart Money behavior.

Because it trades heavily during London and New York sessions, liquidity is constantly generated and removed.

This is why you’ll frequently see:

Sudden spikes before major sessions open.

Sharp sweeps before news events (CPI, NFP, FOMC).

Rapid reversals after stop-hunts.

Institutions use gold as a liquidity engine, often hunting both sides of the market before the real move.

🔶 5. How to Identify a Real Liquidity Hunt (Checklist)

Use this professional checklist to train your eye:

✅ Look for equal highs/lows forming before the move.

✅ Wait for a stop-hunt candle — a long wick piercing liquidity zone.

✅ Confirm a market structure shift (MSS or CHoCH) in lower timeframe.

✅ Entry only after displacement and a clean retracement into an order block.

Avoid reacting emotionally to every breakout — Smart Money uses time + patience to trick impulsive traders.

🔶 6. Practical Educational Example

Suppose Gold forms equal highs at $2380 during the London session.

Many retail traders place buy stops above $2380 expecting a breakout.

Institutions see that as a liquidity pool.

Price suddenly spikes to $2385, sweeps those buy stops, and then drops to $2360 — that’s your liquidity hunt.

Once the structure shifts bearish after the sweep, Smart Money has filled sell orders at a premium — and the downtrend resumes.

🔶 7. Educational Takeaway

Smart Money doesn’t predict — it reacts to liquidity.

By understanding where traders are trapped, you align your trades with institutional flow instead of retail emotion.

📘 Key Principles:

Trade after the liquidity grab, not before.

Always wait for confirmation through structure shift.

Focus on zones of interest, not random breakouts.

Observe timing — most liquidity hunts occur during session opens or high-impact news.

💬 Final Note:

Every chart tells a story — but only those who understand liquidity can read the true language of price.

Study it, practice it, and you’ll see how Smart Money creates opportunity through manipulation and order flow.

📘 Follow me for more professional educational content on Smart Money, Liquidity, and Gold market behavior.

Liquidity represents the orders resting above or below obvious price levels — mainly stop-losses and pending orders placed by retail traders.

In simple terms, where you see equal highs, equal lows, or strong swing points, that’s where liquidity pools exist.

On Gold (XAUUSD), because of its volatility, liquidity often accumulates near:

Double tops or double bottoms.

Previous day highs/lows.

Fair value gaps (imbalances).

Psychological round levels like $2300, $2350, $2400, etc.

These zones attract both buyers and sellers — and that’s exactly where Smart Money (institutional traders) aims to act.

🔶 2. What Smart Money Actually Does

Smart Money doesn’t follow retail moves — it creates them.

When price consolidates and retail traders position themselves early, institutions push price beyond these zones to:

Trigger retail stop losses.

Fill their own large institutional orders at better prices.

Remove weak hands from the market.

This process is called a Liquidity Hunt or Stop Hunt.

It’s not manipulation in a malicious sense — it’s simply how large players execute size efficiently in a decentralized market.

🔶 3. The Classic Gold Liquidity Hunt Pattern

Let’s break down a typical Smart Money setup on XAUUSD:

Step 1:

Price builds equal highs (or equal lows) — retail traders see it as a breakout zone.

Step 2:

Institutions push price slightly beyond that area, creating a false breakout.

Stop-losses of early traders are triggered — this is the liquidity grab.

Step 3:

Immediately after the sweep, structure shifts (Change of Character / CHoCH).

This confirms that Smart Money has completed its collection phase and is now ready to move price in the intended direction.

Step 4:

Price often retraces back into the order block or fair value gap left behind by displacement.

This is where the high-probability entry lies — the Smart Money entry point.

🔶 4. Why Gold (XAUUSD) Shows This So Clearly

Gold is one of the most liquid and manipulated markets on the planet — ideal for studying Smart Money behavior.

Because it trades heavily during London and New York sessions, liquidity is constantly generated and removed.

This is why you’ll frequently see:

Sudden spikes before major sessions open.

Sharp sweeps before news events (CPI, NFP, FOMC).

Rapid reversals after stop-hunts.

Institutions use gold as a liquidity engine, often hunting both sides of the market before the real move.

🔶 5. How to Identify a Real Liquidity Hunt (Checklist)

Use this professional checklist to train your eye:

✅ Look for equal highs/lows forming before the move.

✅ Wait for a stop-hunt candle — a long wick piercing liquidity zone.

✅ Confirm a market structure shift (MSS or CHoCH) in lower timeframe.

✅ Entry only after displacement and a clean retracement into an order block.

Avoid reacting emotionally to every breakout — Smart Money uses time + patience to trick impulsive traders.

🔶 6. Practical Educational Example

Suppose Gold forms equal highs at $2380 during the London session.

Many retail traders place buy stops above $2380 expecting a breakout.

Institutions see that as a liquidity pool.

Price suddenly spikes to $2385, sweeps those buy stops, and then drops to $2360 — that’s your liquidity hunt.

Once the structure shifts bearish after the sweep, Smart Money has filled sell orders at a premium — and the downtrend resumes.

🔶 7. Educational Takeaway

Smart Money doesn’t predict — it reacts to liquidity.

By understanding where traders are trapped, you align your trades with institutional flow instead of retail emotion.

📘 Key Principles:

Trade after the liquidity grab, not before.

Always wait for confirmation through structure shift.

Focus on zones of interest, not random breakouts.

Observe timing — most liquidity hunts occur during session opens or high-impact news.

💬 Final Note:

Every chart tells a story — but only those who understand liquidity can read the true language of price.

Study it, practice it, and you’ll see how Smart Money creates opportunity through manipulation and order flow.

📘 Follow me for more professional educational content on Smart Money, Liquidity, and Gold market behavior.

👑 XAU_EMPIRE – XAU/USD Specialist

📊 Professional Forex Trader | Gold Signals Provider

⚡ Smart Money | Technicals | Fundamentals

📈 Daily Accurate Trade Setups & Market Outlook

🔥 Join Exclusive VIP Premium Telegram Channel

t.me/XAUEMPIRE2

📊 Professional Forex Trader | Gold Signals Provider

⚡ Smart Money | Technicals | Fundamentals

📈 Daily Accurate Trade Setups & Market Outlook

🔥 Join Exclusive VIP Premium Telegram Channel

t.me/XAUEMPIRE2

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

👑 XAU_EMPIRE – XAU/USD Specialist

📊 Professional Forex Trader | Gold Signals Provider

⚡ Smart Money | Technicals | Fundamentals

📈 Daily Accurate Trade Setups & Market Outlook

🔥 Join Exclusive VIP Premium Telegram Channel

t.me/XAUEMPIRE2

📊 Professional Forex Trader | Gold Signals Provider

⚡ Smart Money | Technicals | Fundamentals

📈 Daily Accurate Trade Setups & Market Outlook

🔥 Join Exclusive VIP Premium Telegram Channel

t.me/XAUEMPIRE2

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.