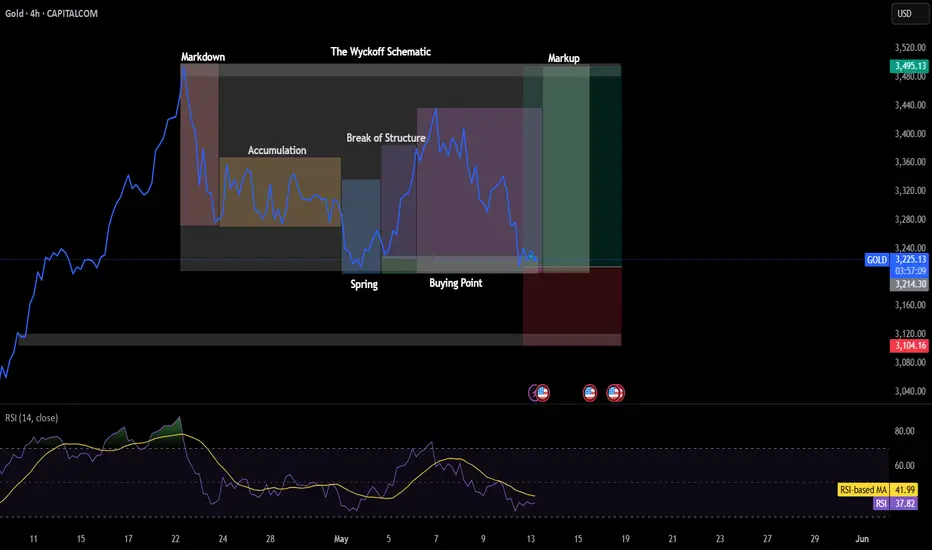

Gold is illustrating a classic Wyckoff Accumulation Schematic on 4-hour timeframe, highlighting a transition from a markdown to a markup phase. Initially, the price drops sharply in the markdown phase, falling from around $3,520, signaling strong selling pressure. This is followed by the accumulation phase, where the price consolidates between approximately $3,105 and $3,215 as institutional players quietly accumulate positions. A brief dip below this range forms the spring around $3,104.16—a false breakdown intended to trap sellers—before the price quickly recovers. The subsequent break of structure above $3,214.30 confirms a shift in market sentiment, leading to a clear buying point in anticipation of a bullish move. Price then enters the markup phase, targeting highs near $3,495.13, with a protective stop-loss ideally placed just below the spring. This structure suggests a strong bullish setup. Ideally this trend can be rode until a strong bearish divergence is observed on the Relative Strength Index

İşlem aktif

Not

Keep holding lads - we marking upFeragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.