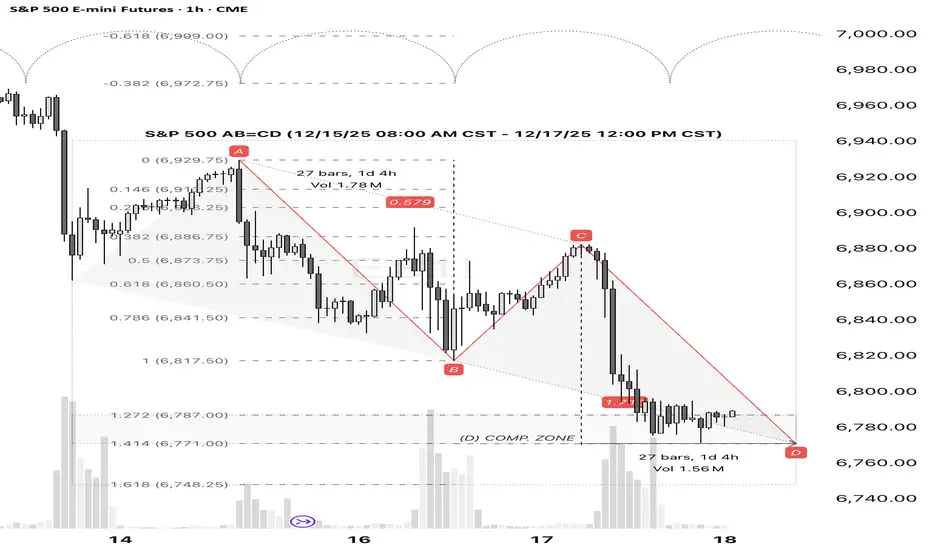

S&P 500 (SPX) - Technical Analysis: Bullish Reversal Signal at AB=CD Completion

1. Pattern Recognition:

A classic bullish AB=CD harmonic pattern has reached its precise completion point (D). This validates the designated support zone as a significant technical area where buyer momentum is anticipated to overcome recent selling pressure.

2. Market Structure Implications:

The successful completion of this pattern suggests:

· The establishment of a firm, technically-defined support level.

· Exhaustion of the prior downward (CD) leg.

· An increased probability of a mean-reversion move higher, targeting a retracement of the recent decline.

3. Trade Thesis & Risk Management:

The confluence at the D point presents a favorable risk/reward opportunity for a long position.

· Action: Initiate long positions.

· Entry Zone: At or near the pattern's D completion point.

· Invalidation Level: A decisive close below the D point invalidates the pattern structure. Place stop loss accordingly.

· Primary Target: The 0.618 Fibonacci retracement of the CD leg.

· Secondary Target: The initiation point (C) of the pattern.

1. Pattern Recognition:

A classic bullish AB=CD harmonic pattern has reached its precise completion point (D). This validates the designated support zone as a significant technical area where buyer momentum is anticipated to overcome recent selling pressure.

2. Market Structure Implications:

The successful completion of this pattern suggests:

· The establishment of a firm, technically-defined support level.

· Exhaustion of the prior downward (CD) leg.

· An increased probability of a mean-reversion move higher, targeting a retracement of the recent decline.

3. Trade Thesis & Risk Management:

The confluence at the D point presents a favorable risk/reward opportunity for a long position.

· Action: Initiate long positions.

· Entry Zone: At or near the pattern's D completion point.

· Invalidation Level: A decisive close below the D point invalidates the pattern structure. Place stop loss accordingly.

· Primary Target: The 0.618 Fibonacci retracement of the CD leg.

· Secondary Target: The initiation point (C) of the pattern.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.