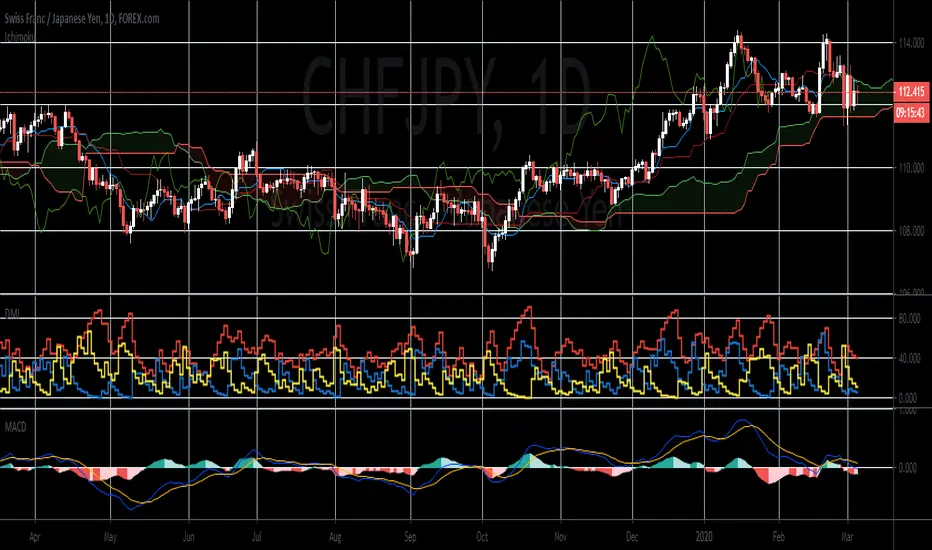

The pair will bounce back from a critical support line, sending it higher towards its previous high. The Swiss Franc stole the spotlight from the Japanese yen as the ideal safe-haven currency among G10 currencies. The Japanese government in February posted its fourth-quarter 2019 GDP growth, which disappointed its investors. Gross domestic product growth came crashing after the figure showed the country growing at -1.6%. If Japan posted another negative growth rate for Q1 2020, Tokyo would enter a technical recession. In Europe, the EU’s economic powerhouses were also experiencing a slowdown in growth. Germany, France, and Italy posted stagnant and negative growth. Germany grew zero percent, while France and Italy entered the negative territory at -0.1% and -0.3%, respectively. Thus, the luster of the Swiss franc as a safe-haven asset outshines all currencies. The country has the lowest interest rate in the world.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.