We are in love with Bitcoin, altcoins and the cryptocurrency market in general, we believe this to be the best alternative available today to centralized fiat money.

If this isn't a substitute, it is still always great to have different options, different choices; alternatives.

So now we are looking at alternative money and it has its advantages and disadvantages just like everything else in this lifetime.

So yes, manipulation is real and does exist. Fraud is also possible and real, and there are all sorts of good, bad and neutral actors in all areas of business and life, but a simple accusation shouldn't be enough for us to call for the new to be transformed into the old... Anyways, let's get to the charts.

We are looking at the difference in price between BitFinex ($5400), CoinBase ($5170) and BitStamp ($5170). We are looking at almost $240 USD in price difference, and each time we have this huge gap, things tend to go sour for Bitcoin (BTCUSD).

Yes, it can go bullish for a few days, but this type of price difference almost always results in a strong drop.

The last time we saw a similar difference in price Bitcoin was really bearish, and as the gap closed and these exchanges reached a balance, Bitcoin (BTCUSD) had a strong bullish wave.

Now we are seeing another Tether (USDT) situation and we really don't know how this will end.

Since we can't predict what will happen next, we can take a look at these charts and the signals coming from it to get an idea of that.

Let's take a look at some really classic signals and take it for what they are worth:

Bitcoin (BTCUSD) Chart Signals

Where to next Bitcoin? Support & Resistance Levels

We all love Bitcoin and we are here for the long term.

We are super bullish long-term and we believe (we KNOW) that Bitcoin is the future.

Looking at it short-term Bitcoin is aiming for a drop, based on the signals coming from this chart... But, this is just our idea based on our experience and the information you see above, please let us know where you think that Bitcoin will go, and feel free to share your thoughts in the comments section below...

This is Alan Masters, thanks a lot for your continued support.

Namaste.

If this isn't a substitute, it is still always great to have different options, different choices; alternatives.

So now we are looking at alternative money and it has its advantages and disadvantages just like everything else in this lifetime.

So yes, manipulation is real and does exist. Fraud is also possible and real, and there are all sorts of good, bad and neutral actors in all areas of business and life, but a simple accusation shouldn't be enough for us to call for the new to be transformed into the old... Anyways, let's get to the charts.

We are looking at the difference in price between BitFinex ($5400), CoinBase ($5170) and BitStamp ($5170). We are looking at almost $240 USD in price difference, and each time we have this huge gap, things tend to go sour for Bitcoin (BTCUSD).

Yes, it can go bullish for a few days, but this type of price difference almost always results in a strong drop.

The last time we saw a similar difference in price Bitcoin was really bearish, and as the gap closed and these exchanges reached a balance, Bitcoin (BTCUSD) had a strong bullish wave.

Now we are seeing another Tether (USDT) situation and we really don't know how this will end.

Since we can't predict what will happen next, we can take a look at these charts and the signals coming from it to get an idea of that.

Let's take a look at some really classic signals and take it for what they are worth:

Bitcoin (BTCUSD) Chart Signals

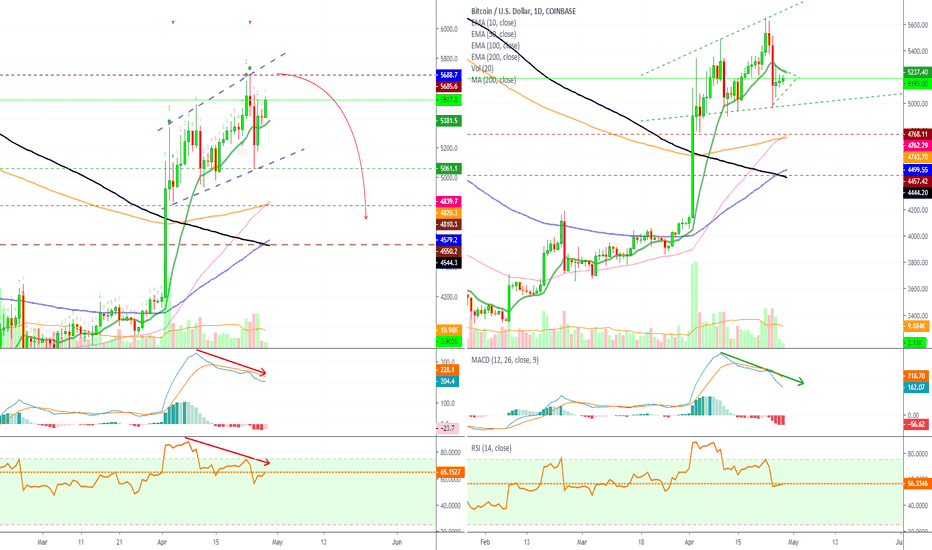

- BTCUSD is now trading above EMA10 (BitFinex), but in other major exchanges (CoinBase & BitStamp), BTCUSD is trading below EMA10. So BitFinex is looking better but the problem remains that BitFinex is trading against Tether (USDT) and not USD, which can explain how it managed to break above EMA10 while this same resistance was rejected in all other exchanges.

- Big volume to break below EMA10, and a subsequent rejection on the bounce (CoinBase and BitStamp). These are bearish signals.

- The MACD is leaning towards the bears on all the exchanges above and shows room for more down. There is also bearish divergence showing up and the histogram moving in favor of the bears.

- The RSI remains strong but is showing bearish divergence as well which is usually a strong signal on this time frame. Normally this signal is pretty accurate when it starts to show up on the 4H time frame, we are looking at BTCUSD daily now and this divergence is very pronunced.

- We can also look at the phase at which this market is at as well as many other factors that support an upcoming drop. Yes we want Bitcoin to continue going up and higher, but based on these signals and past history (you've seen the hundreds of charts comparing BTCUSD to the past and expecting a drop) we are very likely to see a drop.

Where to next Bitcoin? Support & Resistance Levels

- In order for Bitcoin to continue moving up, the first challenge is to break and close above EMA10, with the exception of BitFinex of course. The next challenge would be to break the last high at around $5650. If BTCUSD can break these two resistance levels, then we can consider further growth, for now we focus on EMA10 first, anything below it and Bitcoin remains bearish (Trading below EMA10 = bearish potential).

- On the way down, the first support range is sitting at $4900 - $5000. If this level can be broken, you can expect BTCUSD to test EMA50 ($4750) next, followed by EMA100 which is the lowest for us right now. If this level hits we will need a new analysis depending on how the daily candle closes.

We all love Bitcoin and we are here for the long term.

We are super bullish long-term and we believe (we KNOW) that Bitcoin is the future.

Looking at it short-term Bitcoin is aiming for a drop, based on the signals coming from this chart... But, this is just our idea based on our experience and the information you see above, please let us know where you think that Bitcoin will go, and feel free to share your thoughts in the comments section below...

This is Alan Masters, thanks a lot for your continued support.

Namaste.

Not

(IMPORTANT READ INSIDE) Loom Network, Will It Bounce? + Altcoins Market Analysis and DiscussionHow will the altcoins market react to a strong Bitcoin drop or continuation of an uptrend?

Make sure to read this one if you are into trading and profiting from cryptocurrency long term.

Find out more here:

🚨 LIFETIME (Pay 1, Get 7)

lamatrades.com —Since 2017

🚨 Results

ETH +2150%

CRO +1272%

AAVE +1134%

DOGS +868%

SOL +861%

XRP +749%

BTC +580%

t.me/masteranandatrades/6681

😱 Wow & New Results

t.me/anandatrades/1350

lamatrades.com —Since 2017

🚨 Results

ETH +2150%

CRO +1272%

AAVE +1134%

DOGS +868%

SOL +861%

XRP +749%

BTC +580%

t.me/masteranandatrades/6681

😱 Wow & New Results

t.me/anandatrades/1350

İlgili yayınlar

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

🚨 LIFETIME (Pay 1, Get 7)

lamatrades.com —Since 2017

🚨 Results

ETH +2150%

CRO +1272%

AAVE +1134%

DOGS +868%

SOL +861%

XRP +749%

BTC +580%

t.me/masteranandatrades/6681

😱 Wow & New Results

t.me/anandatrades/1350

lamatrades.com —Since 2017

🚨 Results

ETH +2150%

CRO +1272%

AAVE +1134%

DOGS +868%

SOL +861%

XRP +749%

BTC +580%

t.me/masteranandatrades/6681

😱 Wow & New Results

t.me/anandatrades/1350

İlgili yayınlar

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.