I wasn’t able to post my analysis on TradingView last week, so here’s a structured summary of my ticker reviews from Oct 6–10, segmented by sector with brief commentary. Each includes an update on trend structure and a link to both the original chart and the latest revision as of Friday’s close.

Technology

AMD – Clean follow-through off mid-term support into the upper band of resistance. Strong rejection increases the odds that a mid-term top for the uptrend since April is being formed. Any lower-high formation next week should be approached with caution.

AMD – Clean follow-through off mid-term support into the upper band of resistance. Strong rejection increases the odds that a mid-term top for the uptrend since April is being formed. Any lower-high formation next week should be approached with caution.

Chart:

Previously:

• Upside potential to resistance (Oct 7):

• Downside potential:

• On resistance & bounce potential (Aug 6):

• On macro resistance (Jul 29):

• On macro bottoming potential (Apr):

NVTS – Followed the Aug–Sep setup and delivered a strong breakout Friday, but late-day reversal increases the odds of a longer consolidation into 7.80–6.80 support.

NVTS – Followed the Aug–Sep setup and delivered a strong breakout Friday, but late-day reversal increases the odds of a longer consolidation into 7.80–6.80 support.

Chart:

Previously:

• Breakout and local support (Oct 10):

• Consolidation and upside potential (Sep 30):

• Higher-low potential (Sep 26):

• Mid-term support (Aug 25): tradingview.com/symbols/NASDAQ-NVTS/minds/?mind=TG-GkbRtRaGErSPSXMYcRg

MRVL – Reached the key mid-term resistance zone outlined earlier. Friday’s rejection increases odds of a pullback into 80–72 support over the coming weeks.

MRVL – Reached the key mid-term resistance zone outlined earlier. Friday’s rejection increases odds of a pullback into 80–72 support over the coming weeks.

Chart:

Previously:

• On mid-term top (Oct 10):

• On resistance zone (Oct 2): tradingview.com/symbols/NASDAQ-MRVL/minds/?mind=BTOV58OwQAS_gh52-D_Kvg

WDC – Orderly follow-through to the downside into the 21 EMA.

WDC – Orderly follow-through to the downside into the 21 EMA.

Chart:

Previously: downside potential to 21 EMA –

RBLX – Rejected at local resistance, aligning with the downside structure.

RBLX – Rejected at local resistance, aligning with the downside structure.

Chart:

Previously: downside potential (Oct 8):

REKR – Shows strong relative strength with steady consolidation at support; constructive base-building continues.

REKR – Shows strong relative strength with steady consolidation at support; constructive base-building continues.

Chart:

Previously: follow-through and support (Oct 7):

AI – Friday breakout attempt faded back into support, increasing odds of prolonged base-building and a potential deeper pullback to 17–16.

AI – Friday breakout attempt faded back into support, increasing odds of prolonged base-building and a potential deeper pullback to 17–16.

Chart:

Previously:

On continuation potential (Oct 8):

BB – Failed on immediate continuation and returned to support.

BB – Failed on immediate continuation and returned to support.

Chart:

Previously:

On continuation potential (Oct 8):

OPEN – Constructive consolidation stalled as failed breakouts shifted odds toward a deeper pullback into mid-term support.

OPEN – Constructive consolidation stalled as failed breakouts shifted odds toward a deeper pullback into mid-term support.

Chart:

⸻

Blockchain

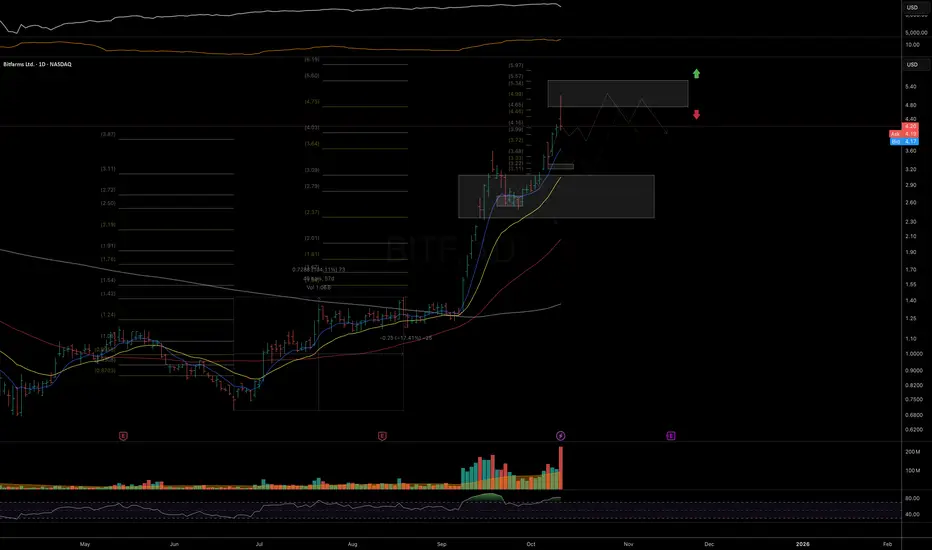

BITF – Tagged the ideal macro resistance zone; odds rise for at least a mid-term top/base formation here.

BITF – Tagged the ideal macro resistance zone; odds rise for at least a mid-term top/base formation here.

Chart:

Previously:

On upside continuation (Oct 7):

HIVE – Rejection at the top of mid-term resistance; probabilities favor the start of a reversal phase.

HIVE – Rejection at the top of mid-term resistance; probabilities favor the start of a reversal phase.

Chart:

Previously:

On macro resistance (Oct 6):

On more immediate upside potential (Sep 24): tradingview.com/symbols/NASDAQ-HIVE/minds/?mind=Vd571diiT1u3xVGH1kGhKw

•On bullish potential (Sep 10): tradingview.com/symbols/NASDAQ-HIVE/minds/?mind=UqHPKBdtQzCEipcKminPNQ

• On bullish trend structure (Jul 21): tradingview.com/symbols/NASDAQ-HIVE/minds/?mind=Y4zxqZwzRtyaDD8lmywGhw

BKKT – No follow-through on continuation setup, but key local support still holds; structure remains intact while above it.

BKKT – No follow-through on continuation setup, but key local support still holds; structure remains intact while above it.

Chart:

Previously:

On continuation (Oct 9):

BULL – Rotating back toward macro support near 11; monitoring for higher-low formation and reversal trigger.

BULL – Rotating back toward macro support near 11; monitoring for higher-low formation and reversal trigger.

Chart:

Previously:

On reversal and macro support (Oct 8):

On immediate bullish potential (Sep 26): tradingview.com/symbols/NASDAQ-BULL/minds/?mind=GqGeyQoBR6SKSPusscGaaA

• On macro support (Sep 19): tradingview.com/symbols/NASDAQ-BULL/minds/?mind=1zpzfLwhSNyk5xrc_bXRBg

• On macro support (Sep 4): tradingview.com/symbols/NASDAQ-BULL/minds/?mind=6lTB3WHIQAiRNPeDukZ1Wg&exchange=NASDAQ

• On mid-term resistance (Aug 6): tradingview.com/symbols/NASDAQ-BULL/minds/?mind=7SfNQ0fPQY2Zet6MU4KB6g&exchange=NASDAQ

• On support and bounce potential (Jul 30): tradingview.com/symbols/NASDAQ-BULL/minds/?mind=XQmtVEynRcu7Pye2Rw0E9Q&exchange=NASDAQ

BTM – Bullish setup invalidated by breakdown into mid-term support.

BTM – Bullish setup invalidated by breakdown into mid-term support.

Chart:

Previously:

On bullish follow-through if LOD holds (Oct 6):

⸻

Biotechnology / Healthcare

VKTX – Strong follow-through from September update; watching for consolidation back into key EMAs to reset momentum.

VKTX – Strong follow-through from September update; watching for consolidation back into key EMAs to reset momentum.

Chart:

Previously:

On follow-through (Oct 6):

• On break-out potential (Sep 30): tradingview.com/symbols/NASDAQ-VKTX/minds/?mind=RyuxrFPaTMyJkFMZLAfOoQ

• On resistance zone (Aug 11): tradingview.com/symbols/NASDAQ-VKTX/minds/?mind=VLFAH1asTO2WJt4Y-TgXyw

• On upside momentum continuation (Jul 18): tradingview.com/symbols/NASDAQ-VKTX/minds/?mind=4owGJV5ZQaO33WP1hAviSg

• Original setup (Jun 30): tradingview.com/symbols/NASDAQ-VKTX/minds/?mind=Ug0UI_DXRAu5b95LGXIyog

• Follow-up (Jul 8): tradingview.com/symbols/NASDAQ-VKTX/minds/?mind=fZQV2wcyRL2hB7nariJikg

NTLA – Clean follow-through into mid-term resistance; rising odds for a topping/base formation.

NTLA – Clean follow-through into mid-term resistance; rising odds for a topping/base formation.

Chart:

Previously:

On break-out to resistance zone (Oct 8):

On support and bullish trend-structure (Sep 26): tradingview.com/symbols/NASDAQ-NTLA/minds/?mind=B8f6LFmoSxGopGgzEMnUPQ

PGEN – Couldn’t stage a recovery yet but remains within mid-term support; stabilization needed for a constructive setup.

PGEN – Couldn’t stage a recovery yet but remains within mid-term support; stabilization needed for a constructive setup.

Chart:

Previously:

On potential reversal (Oct 8):

On mid-term support (Sep 15): tradingview.com/symbols/NASDAQ-PGEN/minds/?mind=Wd5W0WZ3R-qeB9zVjFAHHw

ABCL – Momentum attempt resumed but failed to follow-through; still constructive above 21 EMA.

ABCL – Momentum attempt resumed but failed to follow-through; still constructive above 21 EMA.

Chart:

Previously:

On local support and continuation potential (Oct 8):

On support and bullish trend-structure (Oct 7):

⸻

Energy

GTE – Impulsive advance at risk of morphing into a diagonal correction; elevated probability of retesting September higher lows.

GTE – Impulsive advance at risk of morphing into a diagonal correction; elevated probability of retesting September higher lows.

Chart:

Previously:

On constructive looking consolidation (Oct 6):

⸻

Miscellaneous / Other

SLDP – Rising risk of a local top after Friday’s distribution; while above 21 EMA, a final push into resistance remains possible.

SLDP – Rising risk of a local top after Friday’s distribution; while above 21 EMA, a final push into resistance remains possible.

Chart:

Previously:

On follow-through and resistance zone (Oct 6):

On mid-term support and bullish potential (Sep 19): tradingview.com/symbols/NASDAQ-SLDP/minds/?mind=DStjOaOpSeGPWFwB-md_dA

DPRO – Solid 2.5-day follow-through from the Oct update; Friday’s action suggests increased consolidation or reversal risk.

DPRO – Solid 2.5-day follow-through from the Oct update; Friday’s action suggests increased consolidation or reversal risk.

Chart:

Previously:

On local support and continuation (Oct 7):

DLO – Disappointing fade after a promising start; must hold above 50-DMA to reassert upside momentum.

DLO – Disappointing fade after a promising start; must hold above 50-DMA to reassert upside momentum.

Chart:

Previously:

On break-out potential (Oct 8):

On pullback potential (Sep 22): tradingview.com/symbols/NASDAQ-DLO/minds/?mind=Zjk8an6VRFSLNP-Fdy3u7g

• On downside potential and support (Sep 3): tradingview.com/symbols/NASDAQ-DLO/minds/?mind=ceWeIiDKQ9-w4TabhWnsUw

Thank you for your attention and have a great start of the week!

Technology

Chart:

Previously:

• Upside potential to resistance (Oct 7):

• Downside potential:

• On resistance & bounce potential (Aug 6):

• On macro resistance (Jul 29):

• On macro bottoming potential (Apr):

Chart:

Previously:

• Breakout and local support (Oct 10):

• Consolidation and upside potential (Sep 30):

• Higher-low potential (Sep 26):

• Mid-term support (Aug 25): tradingview.com/symbols/NASDAQ-NVTS/minds/?mind=TG-GkbRtRaGErSPSXMYcRg

Chart:

Previously:

• On mid-term top (Oct 10):

• On resistance zone (Oct 2): tradingview.com/symbols/NASDAQ-MRVL/minds/?mind=BTOV58OwQAS_gh52-D_Kvg

Chart:

Previously: downside potential to 21 EMA –

Chart:

Previously: downside potential (Oct 8):

Chart:

Previously: follow-through and support (Oct 7):

Chart:

Previously:

On continuation potential (Oct 8):

Chart:

Previously:

On continuation potential (Oct 8):

Chart:

⸻

Blockchain

Chart:

Previously:

On upside continuation (Oct 7):

Chart:

Previously:

On macro resistance (Oct 6):

On more immediate upside potential (Sep 24): tradingview.com/symbols/NASDAQ-HIVE/minds/?mind=Vd571diiT1u3xVGH1kGhKw

•On bullish potential (Sep 10): tradingview.com/symbols/NASDAQ-HIVE/minds/?mind=UqHPKBdtQzCEipcKminPNQ

• On bullish trend structure (Jul 21): tradingview.com/symbols/NASDAQ-HIVE/minds/?mind=Y4zxqZwzRtyaDD8lmywGhw

Chart:

Previously:

On continuation (Oct 9):

Chart:

Previously:

On reversal and macro support (Oct 8):

On immediate bullish potential (Sep 26): tradingview.com/symbols/NASDAQ-BULL/minds/?mind=GqGeyQoBR6SKSPusscGaaA

• On macro support (Sep 19): tradingview.com/symbols/NASDAQ-BULL/minds/?mind=1zpzfLwhSNyk5xrc_bXRBg

• On macro support (Sep 4): tradingview.com/symbols/NASDAQ-BULL/minds/?mind=6lTB3WHIQAiRNPeDukZ1Wg&exchange=NASDAQ

• On mid-term resistance (Aug 6): tradingview.com/symbols/NASDAQ-BULL/minds/?mind=7SfNQ0fPQY2Zet6MU4KB6g&exchange=NASDAQ

• On support and bounce potential (Jul 30): tradingview.com/symbols/NASDAQ-BULL/minds/?mind=XQmtVEynRcu7Pye2Rw0E9Q&exchange=NASDAQ

Chart:

Previously:

On bullish follow-through if LOD holds (Oct 6):

⸻

Biotechnology / Healthcare

Chart:

Previously:

On follow-through (Oct 6):

• On break-out potential (Sep 30): tradingview.com/symbols/NASDAQ-VKTX/minds/?mind=RyuxrFPaTMyJkFMZLAfOoQ

• On resistance zone (Aug 11): tradingview.com/symbols/NASDAQ-VKTX/minds/?mind=VLFAH1asTO2WJt4Y-TgXyw

• On upside momentum continuation (Jul 18): tradingview.com/symbols/NASDAQ-VKTX/minds/?mind=4owGJV5ZQaO33WP1hAviSg

• Original setup (Jun 30): tradingview.com/symbols/NASDAQ-VKTX/minds/?mind=Ug0UI_DXRAu5b95LGXIyog

• Follow-up (Jul 8): tradingview.com/symbols/NASDAQ-VKTX/minds/?mind=fZQV2wcyRL2hB7nariJikg

Chart:

Previously:

On break-out to resistance zone (Oct 8):

On support and bullish trend-structure (Sep 26): tradingview.com/symbols/NASDAQ-NTLA/minds/?mind=B8f6LFmoSxGopGgzEMnUPQ

Chart:

Previously:

On potential reversal (Oct 8):

On mid-term support (Sep 15): tradingview.com/symbols/NASDAQ-PGEN/minds/?mind=Wd5W0WZ3R-qeB9zVjFAHHw

Chart:

Previously:

On local support and continuation potential (Oct 8):

On support and bullish trend-structure (Oct 7):

⸻

Energy

Chart:

Previously:

On constructive looking consolidation (Oct 6):

⸻

Miscellaneous / Other

Chart:

Previously:

On follow-through and resistance zone (Oct 6):

On mid-term support and bullish potential (Sep 19): tradingview.com/symbols/NASDAQ-SLDP/minds/?mind=DStjOaOpSeGPWFwB-md_dA

Chart:

Previously:

On local support and continuation (Oct 7):

Chart:

Previously:

On break-out potential (Oct 8):

On pullback potential (Sep 22): tradingview.com/symbols/NASDAQ-DLO/minds/?mind=Zjk8an6VRFSLNP-Fdy3u7g

• On downside potential and support (Sep 3): tradingview.com/symbols/NASDAQ-DLO/minds/?mind=ceWeIiDKQ9-w4TabhWnsUw

Thank you for your attention and have a great start of the week!

📊 Daily FREE Market Insights | Crypto + US Stocks

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

Join and let's grow together! 🚀

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

Join and let's grow together! 🚀

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

📊 Daily FREE Market Insights | Crypto + US Stocks

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

Join and let's grow together! 🚀

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

Join and let's grow together! 🚀

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.