📅 BANK NIFTY Trading Plan – 20th May 2025

🕒 Timeframe: 15-Minute | 🎯 Strategy: Price Action + Reaction Zones + Risk Management Principles

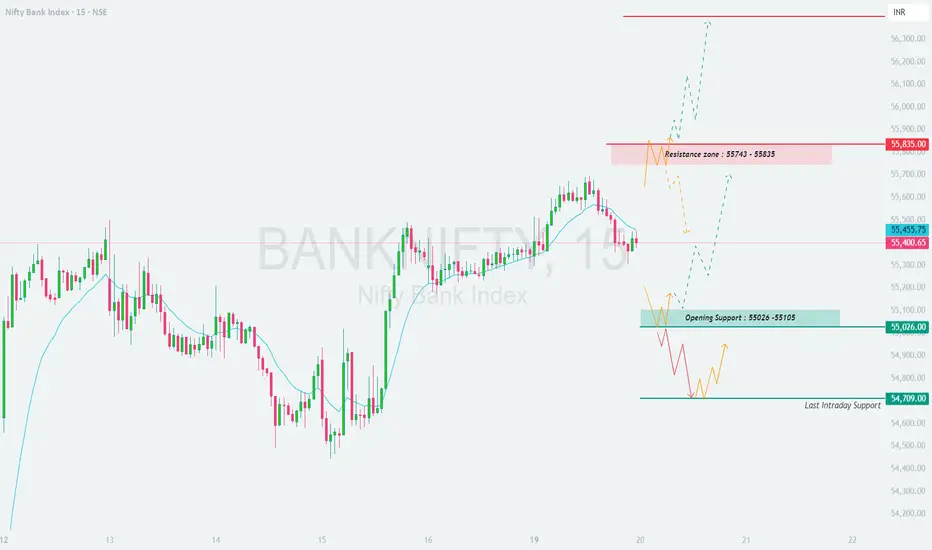

📌 Key Intraday Levels:

🔴 Resistance Zone: 55,743 – 55,835

🟦 Opening Support Zone: 55,026 – 55,105

🟫 Last Intraday Support: 54,709

📈 Scenario 1: GAP UP Opening (🔺 +200 points or more) – Opening Above 55,743

If Bank Nifty opens directly inside or above the resistance zone of 55,743–55,835, it's crucial not to chase the move blindly. This zone can act as a strong supply area where profit-booking or shorting by institutions may occur.

📌 Educational Tip: A gap-up into resistance isn’t a buy signal by default. It's a “wait & watch” zone. Let smart money reveal its hand.

⚖️ Scenario 2: FLAT Opening (Within ±100 points) – Between 55,300 – 55,500

A flat or minor gap opening inside the midpoint of the prior range creates a neutral setup, allowing for price discovery in either direction.

📌 Educational Tip: Flat opens are common traps for impatient traders. Observe the first move, then plan the second move — it’s often more rewarding.

📉 Scenario 3: GAP DOWN Opening (🔻 -200 points or more) – Below 55,026

A gap-down below the opening support range (55,026–55,105) creates a bearish sentiment, but it must be confirmed with price action.

📌 Educational Tip: Gap-downs into key support areas often fake breakdowns before a reversal. Only act when price confirms with conviction.

🛡️ Options Trading – Risk Management Tips:

✅ Define Maximum Risk: Only use capital you can afford to lose. Never go all-in on directional option trades.

✅ Avoid Illiquid Strikes: Stick to ATM/1-step ITM or OTM strikes with good liquidity to avoid slippage.

✅ Use Spreads to Your Advantage: Credit spreads (Bear Call, Bull Put) work well in rangebound days.

✅ Don’t Chase Premiums: Avoid overpaying for options after the move. Wait for cooling off or structure risk via spreads.

✅ Set SL on Premium Value: Instead of index, SL based on option premium value (e.g., 40–50% loss) improves consistency.

✅ Avoid Carrying Naked Trades Overnight: Especially on Fridays or before events. Use hedging (e.g., protective puts or calls).

📊 Summary & Action Plan:

🔼 Above 55,835: Bullish continuation zone → Target 56,000 – 56,200

🔄 Between 55,300 – 55,500: Neutral zone → Wait for breakout or breakdown

🔽 Below 55,026: Bearish sentiment → Watch for reversal at 54,709 or breakdown continuation

📌 Golden Rule: Let price show intent. Follow levels, not emotions. Never compromise on risk management.

📢 Disclaimer:

I am not a SEBI-registered analyst. The content above is purely for educational and informational purposes. Please do your own research or consult a registered financial advisor before taking any trading decisions.

🕒 Timeframe: 15-Minute | 🎯 Strategy: Price Action + Reaction Zones + Risk Management Principles

📌 Key Intraday Levels:

🔴 Resistance Zone: 55,743 – 55,835

🟦 Opening Support Zone: 55,026 – 55,105

🟫 Last Intraday Support: 54,709

📈 Scenario 1: GAP UP Opening (🔺 +200 points or more) – Opening Above 55,743

If Bank Nifty opens directly inside or above the resistance zone of 55,743–55,835, it's crucial not to chase the move blindly. This zone can act as a strong supply area where profit-booking or shorting by institutions may occur.

- []Wait for a clear 15-minute candle close above 55,835 with strong momentum and volume to confirm breakout strength.

[]Once confirmed, target upside zones like 56,000 → 56,200+ can be achievable in intraday.

[]However, if Bank Nifty opens in the resistance zone and shows rejection (e.g., long upper wicks, bearish candles), this becomes a high-probability short setup back toward 55,600 → 55,450.

[]Risk-to-reward is often unfavorable on immediate buying after a gap-up unless confirmation is present.

📌 Educational Tip: A gap-up into resistance isn’t a buy signal by default. It's a “wait & watch” zone. Let smart money reveal its hand.

⚖️ Scenario 2: FLAT Opening (Within ±100 points) – Between 55,300 – 55,500

A flat or minor gap opening inside the midpoint of the prior range creates a neutral setup, allowing for price discovery in either direction.

- []Avoid aggressive trades in the first 15–30 minutes. Wait for directional clarity.

[]A breakout above 55,743 with a strong candle can lead to an intraday up-move toward 55,835 → 56,000+.

[]On the downside, a break below 55,300 can drag the index toward 55,100 → 55,026.

[]Let price retest the support/resistance zone for safer risk-reward setups. - Consider using straddles or non-directional strategies if the index consolidates for 30–45 minutes with low volume.

📌 Educational Tip: Flat opens are common traps for impatient traders. Observe the first move, then plan the second move — it’s often more rewarding.

📉 Scenario 3: GAP DOWN Opening (🔻 -200 points or more) – Below 55,026

A gap-down below the opening support range (55,026–55,105) creates a bearish sentiment, but it must be confirmed with price action.

- []If price opens below 55,026 and sustains below 54,950, a fall toward 54,709 (last intraday support) is highly probable.

[]Break below 54,709 with volume opens the path to 54,500 → 54,350. Use this zone cautiously for fresh shorts only after confirmation.

[]Watch for possible bounce-back if price sharply reverses from 54,709 with a bullish pattern (like hammer or bullish engulfing). This could trigger a reversal toward 55,100+.

[]Avoid bottom-fishing in the first 15 minutes unless you see solid reversal candles with volume confirmation.

📌 Educational Tip: Gap-downs into key support areas often fake breakdowns before a reversal. Only act when price confirms with conviction.

🛡️ Options Trading – Risk Management Tips:

✅ Define Maximum Risk: Only use capital you can afford to lose. Never go all-in on directional option trades.

✅ Avoid Illiquid Strikes: Stick to ATM/1-step ITM or OTM strikes with good liquidity to avoid slippage.

✅ Use Spreads to Your Advantage: Credit spreads (Bear Call, Bull Put) work well in rangebound days.

✅ Don’t Chase Premiums: Avoid overpaying for options after the move. Wait for cooling off or structure risk via spreads.

✅ Set SL on Premium Value: Instead of index, SL based on option premium value (e.g., 40–50% loss) improves consistency.

✅ Avoid Carrying Naked Trades Overnight: Especially on Fridays or before events. Use hedging (e.g., protective puts or calls).

📊 Summary & Action Plan:

🔼 Above 55,835: Bullish continuation zone → Target 56,000 – 56,200

🔄 Between 55,300 – 55,500: Neutral zone → Wait for breakout or breakdown

🔽 Below 55,026: Bearish sentiment → Watch for reversal at 54,709 or breakdown continuation

📌 Golden Rule: Let price show intent. Follow levels, not emotions. Never compromise on risk management.

📢 Disclaimer:

I am not a SEBI-registered analyst. The content above is purely for educational and informational purposes. Please do your own research or consult a registered financial advisor before taking any trading decisions.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.