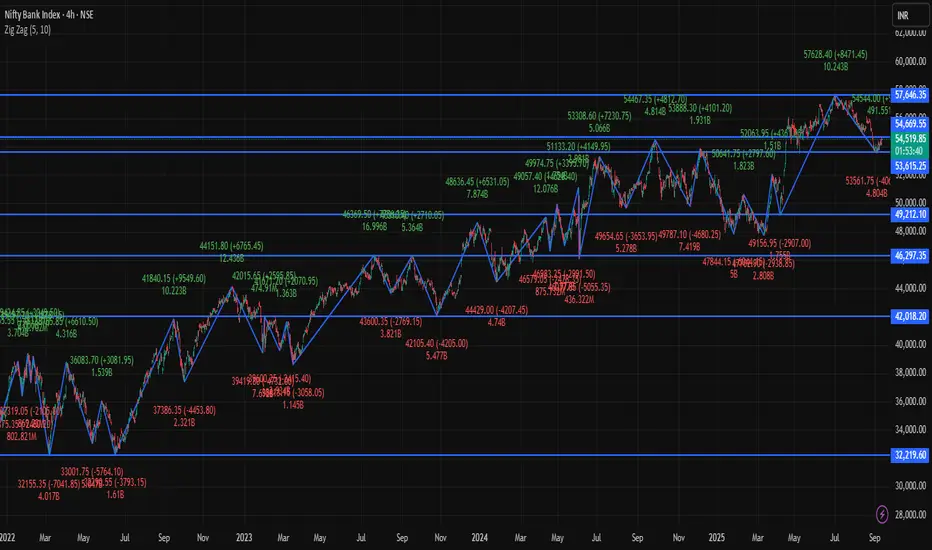

Bank Nifty Snapshot (10 Sept 2025 – 4-Hour Chart)

Current Level: Around 54,550 – 54,650

Intraday Change: Up about +330 to +440 points (~+0.7%)

Trend: Bullish, price holding near highs

Key Pivot Levels (Daily Basis – useful on 4H)

Pivot Point: 54,352

Resistance Levels:

R1: 54,487

R2: 54,623

R3: 54,759

Support Levels:

S1: 54,215

S2: 54,080

S3: 53,944

Technical View (4-Hour Frame)

Momentum: Price is trading above R2 (54,623) → shows strong bullish bias.

Indicators: RSI near 65–70 (bullish), MACD positive, moving averages aligned upward.

Bias:

Sustaining above 54,623 → next upside toward 54,759 and beyond.

If it falls back below Pivot (54,352) → downside risk toward 54,215 or 54,080.

✅ Conclusion: On the 4-hour timeframe, Bank Nifty is bullish, trading above major resistance zones. If strength holds, higher levels are possible, but profit-booking can trigger quick pullbacks toward support.

Current Level: Around 54,550 – 54,650

Intraday Change: Up about +330 to +440 points (~+0.7%)

Trend: Bullish, price holding near highs

Key Pivot Levels (Daily Basis – useful on 4H)

Pivot Point: 54,352

Resistance Levels:

R1: 54,487

R2: 54,623

R3: 54,759

Support Levels:

S1: 54,215

S2: 54,080

S3: 53,944

Technical View (4-Hour Frame)

Momentum: Price is trading above R2 (54,623) → shows strong bullish bias.

Indicators: RSI near 65–70 (bullish), MACD positive, moving averages aligned upward.

Bias:

Sustaining above 54,623 → next upside toward 54,759 and beyond.

If it falls back below Pivot (54,352) → downside risk toward 54,215 or 54,080.

✅ Conclusion: On the 4-hour timeframe, Bank Nifty is bullish, trading above major resistance zones. If strength holds, higher levels are possible, but profit-booking can trigger quick pullbacks toward support.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.