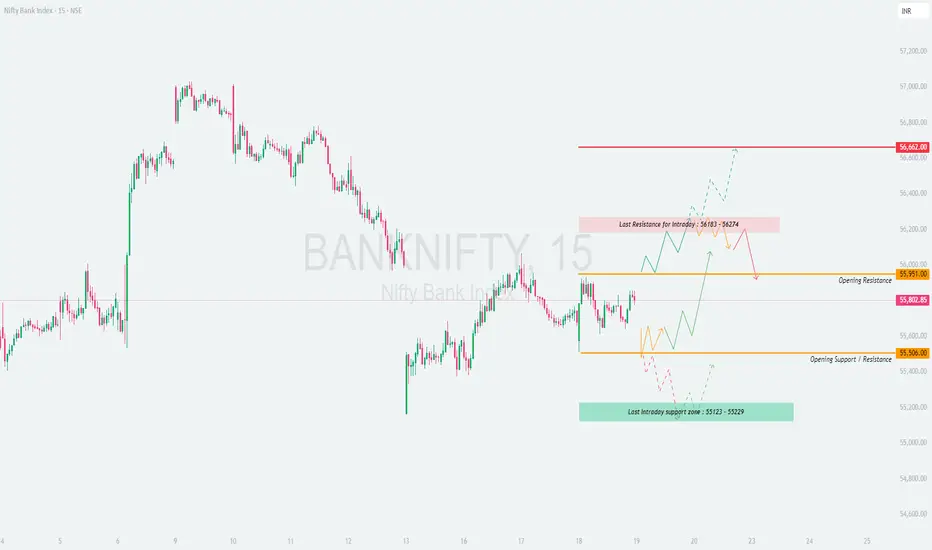

🏦 BANK NIFTY TRADING PLAN – 19-JUNE-2025

📊 Previous Close: 55,802.85 | ⏱️ Timeframe: 15-min

📏 Gap Classification: 200+ points

📊 Previous Close: 55,802.85 | ⏱️ Timeframe: 15-min

📏 Gap Classification: 200+ points

- 🚀 GAP-UP OPENING (Above 56,151+):

A 200+ point gap-up above 56,151 would bring prices near or into the Last Intraday Resistance Zone: 56,183 – 56,274.

✅ Plan of Action:

• If price sustains above 56,274, consider long entries toward the next major level at 56,662.

• Look for consolidation or flag breakout on 5/15-min charts before entry.

• Stop-loss: Below 56,150 on 15-min closing basis.

• If price fails near resistance zone, watch for reversal setups (like bearish engulfing or evening star) to take short trades back toward 55,951 (Opening Resistance).

📘 Tip: Avoid impulsive longs into resistance. Let breakout candles confirm move, especially post initial volatility window (9:15–9:45 AM).

- ⚖️ FLAT OPENING (Between 55,506 – 55,951):

This is the equilibrium area between support and resistance. Expect range-bound or breakout trades.

✅ Plan of Action:

• Wait for breakout above 55,951 to go long toward 56,274, with SL below 55,880.

• A breakdown below 55,506 may trigger short trades toward 55,229, SL above 55,600.

• Avoid trading within the range unless price forms a clear structure (e.g., bullish/bearish flag, wedge).

📘 Tip: In tight ranges, capital preservation is key. Be reactive — not predictive — until direction is confirmed.

- 📉 GAP-DOWN OPENING (Below 55,300):

If Bank Nifty opens below 55,300, it will be near or inside the Last Intraday Support Zone: 55,123 – 55,229.

✅ Plan of Action:

• If the index holds above 55,123 and shows reversal candles, consider long trades back toward 55,506, SL below 55,100.

• If price breaks below 55,123 and sustains, expect further downside toward 54,850 or lower — initiate short trades.

• Confirm with 15-min structure — avoid entering against the trend.

📘 Tip: Don't try to "guess the bottom" in a gap-down. Let price reclaim and hold a key level before reversal trades.

🛡 OPTIONS TRADING – RISK MANAGEMENT TIPS:

✅ 1. Position Sizing: Use only 1–2% of capital per trade, especially during volatile openings.

✅ 2. Use OTM Spreads: Instead of buying naked options, use bull call or bear put spreads to limit risk.

✅ 3. Don’t Chase IV Spikes: Gaps often increase premiums. Wait for IV cooling or use spreads.

✅ 4. Exit on Time Decay: If your option hasn’t moved favorably within 30–45 mins post breakout, consider exiting.

✅ 5. Trade with Confirmation: Don’t react solely to gap openings — let price settle and show structure.

📌 SUMMARY – KEY LEVELS TO WATCH:

🟩 Support Zones:

• Opening Support / Resistance: 55,506

• Last Intraday Support Zone: 55,123 – 55,229

🟥 Resistance Zones:

• Opening Resistance: 55,951

• Last Intraday Resistance: 56,183 – 56,274

• Next Upside Target: 56,662

📈 Trade Bias Zones:

• Above 55,951 → Trend shifts to bullish

• Below 55,506 → Weakness sets in

• Below 55,123 → Aggressive bearish pressure likely

📢 DISCLAIMER: I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Please consult with your financial advisor or conduct your own analysis before making any investment or trading decisions.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.