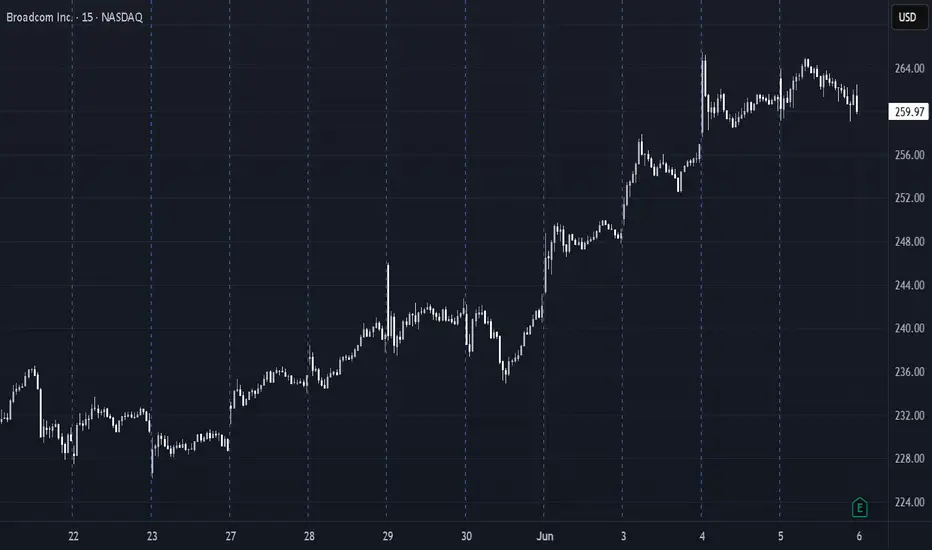

💥 AVGO Earnings Setup – Overbought + “Sell the News” Risk 🚨

📆 Earnings Date: June 5, 2025 (AMC)

🎯 Strategy: One-day event play using short-dated puts

🧠 Model Consensus Breakdown

Model Bias Strike Trade Type Confidence Notes

Grok/xAI 🟢 Bullish 262.5C Call 70% Sector momentum, IV high

Claude 🔴 Bearish 250P Put 65% Overbought RSI, max pain risk

Llama 🟢 Bullish 265C Call 80% Earnings momentum continues

Gemini 🔴 Bearish 242.5P Put 65% “Sell the news” scenario

DeepSeek 🔴 Bearish 237.5P Put 68% Institutional unwind

✅ Net Lean: Moderately Bearish (3 vs. 2)

📈 RSI > 80 across models → strong overbought condition

💣 Max Pain at $245 → gravity risk if earnings disappoint

📉 Elevated IV (75–85%) → IV crush post-earnings expected

🔎 Earnings Setup Snapshot

Current Price: ~$258.20

Historical Move (Earnings): ±5.9%

Implied Move (Straddle): ~6.15% → ~$16

Max Pain: $245

IV Rank: 0.75 → premiums rich

Overbought RSI: 82.6

✅ Recommended Trade Setup

Parameter Value

Instrument AVGO

Direction PUT (SHORT)

Strike 242.50

Expiry 2025-06-06

Entry Price $1.88 (ask)

Profit Target $4.70 (+150%)

Stop Loss $1.88 (full risk)

Position Size 1 contract (~3% risk)

Entry Timing pre-earnings close (6/5)

Exit Timing next-day open (6/6)

Confidence 67%

🧮 Breakeven: $240.62

🧠 Why this strike?

Inside expected move range

OTM → strong R:R

Low premium, defined risk

Aligned with bearish consensus

⚠️ Key Risks to Monitor

🔼 Strong beat + guidance → upside surprise

🌀 IV crush could outpace downside move

🟢 Broad market strength / sector rally

📆 Earnings Date: June 5, 2025 (AMC)

🎯 Strategy: One-day event play using short-dated puts

🧠 Model Consensus Breakdown

Model Bias Strike Trade Type Confidence Notes

Grok/xAI 🟢 Bullish 262.5C Call 70% Sector momentum, IV high

Claude 🔴 Bearish 250P Put 65% Overbought RSI, max pain risk

Llama 🟢 Bullish 265C Call 80% Earnings momentum continues

Gemini 🔴 Bearish 242.5P Put 65% “Sell the news” scenario

DeepSeek 🔴 Bearish 237.5P Put 68% Institutional unwind

✅ Net Lean: Moderately Bearish (3 vs. 2)

📈 RSI > 80 across models → strong overbought condition

💣 Max Pain at $245 → gravity risk if earnings disappoint

📉 Elevated IV (75–85%) → IV crush post-earnings expected

🔎 Earnings Setup Snapshot

Current Price: ~$258.20

Historical Move (Earnings): ±5.9%

Implied Move (Straddle): ~6.15% → ~$16

Max Pain: $245

IV Rank: 0.75 → premiums rich

Overbought RSI: 82.6

✅ Recommended Trade Setup

Parameter Value

Instrument AVGO

Direction PUT (SHORT)

Strike 242.50

Expiry 2025-06-06

Entry Price $1.88 (ask)

Profit Target $4.70 (+150%)

Stop Loss $1.88 (full risk)

Position Size 1 contract (~3% risk)

Entry Timing pre-earnings close (6/5)

Exit Timing next-day open (6/6)

Confidence 67%

🧮 Breakeven: $240.62

🧠 Why this strike?

Inside expected move range

OTM → strong R:R

Low premium, defined risk

Aligned with bearish consensus

⚠️ Key Risks to Monitor

🔼 Strong beat + guidance → upside surprise

🌀 IV crush could outpace downside move

🟢 Broad market strength / sector rally

Free Signals Based on Latest AI models💰: QuantSignals.xyz

İlgili yayınlar

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

İlgili yayınlar

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.