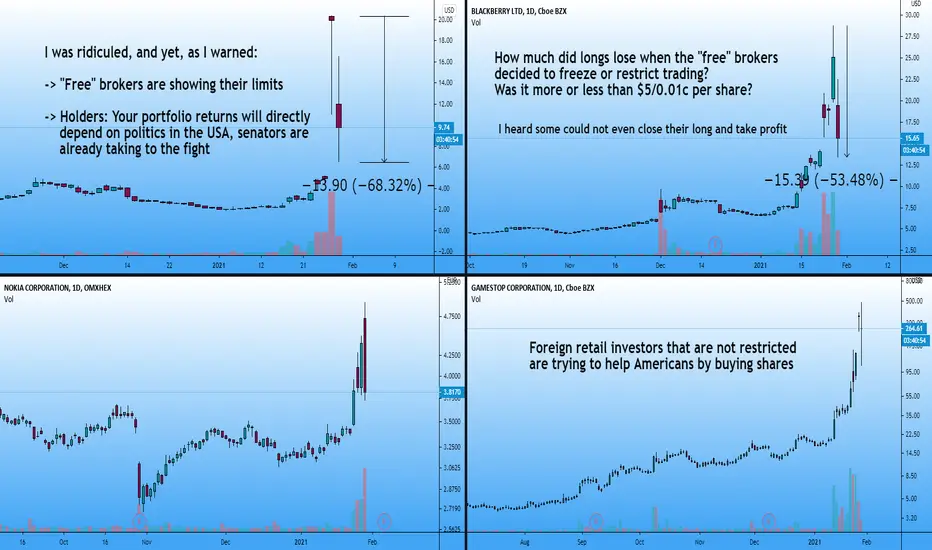

Zero Commission trading: GME, AMC & others get blocked and crash

Price is crashing on low volume for GME & AMC.

TD Ameritrade restricted operations on GME, AMC & other securities

Robinhood removed GameStop, AMC, Blackberry, Nokia and others

Interactive Brokers has put AMC, BB, EXPR, GME, and KOSS option trading into liquidation

Charles Schwab raised the margin requirement to trade GME (blocking small accounts from buying it)

Those brokers cover most of the US retail market, and it is possible more have enacted restrictions

"Robinhood". "Take from the rich to give to the poor". Here it's rather take from the poor so the rich can crash the price and exit.

Melvin Confirms $2.75 Billion Investment from Citadel and Point72 Following Losses, Including GameStop (GME) Short

I heard but could not confirm Citadel were short on some of those securities

Citadel is Robinhood major client that buys their client order flow

So this is how it is: They make money by taking the opposite side of retail, and when they lose they ask their zero-commission pets to stop their clients from buying

This is from CNBC:

“This is a big problem of the e-brokers’ own making as they are so beholden to their payment for order flow overlords and shows the real fragility of the zero commission business model,” said Timothy Welsh, founder and CEO of wealth management consulting firm Nexus Strategy.

And world famous AOC criticized the brokers actions, she is a member of the Financial Services Committee and would support a hearing.

A few days ago senator Elizabeth Warren said something had to be done, I believe she meant bail out her billionaire buddies.

As you may know there is a divide in the US democrat party, between socialists (incl AOC) and "typical" dems.

This will get politicized, and your portfolio returns will depend directly on US politics.

Also, if these plays continue to be possible will depend on US congress and NOT on magical indicators.

The left in the US (the people around Bernie Sanders) will likely fight in favor of the small guy, republicans and old school democrats will defend "systemic risk" in other words the big funds, libertarians (a few republicans + Tulsi Gabbard I'd say) might defend retail investors.

But I really expect the same old dems & republicans to win and stop the infinite free money hack, a lot of people really won't like it, and it adds another brick to the wall of divide+tensions+radicalisation.

Billionaires will get bailed out, but since they burned themselves I think they are going to calm down with the shorting and fear mongering.

Unless crazy laws that overwhelmingly favor them get voted, at that point this would not even surprise me...

For once the little guys won and beat the corrupt insiders, and so they cheated to avoid losing.

TD Ameritrade restricted operations on GME, AMC & other securities

Robinhood removed GameStop, AMC, Blackberry, Nokia and others

Interactive Brokers has put AMC, BB, EXPR, GME, and KOSS option trading into liquidation

Charles Schwab raised the margin requirement to trade GME (blocking small accounts from buying it)

Those brokers cover most of the US retail market, and it is possible more have enacted restrictions

"Robinhood". "Take from the rich to give to the poor". Here it's rather take from the poor so the rich can crash the price and exit.

Melvin Confirms $2.75 Billion Investment from Citadel and Point72 Following Losses, Including GameStop (GME) Short

I heard but could not confirm Citadel were short on some of those securities

Citadel is Robinhood major client that buys their client order flow

So this is how it is: They make money by taking the opposite side of retail, and when they lose they ask their zero-commission pets to stop their clients from buying

This is from CNBC:

“This is a big problem of the e-brokers’ own making as they are so beholden to their payment for order flow overlords and shows the real fragility of the zero commission business model,” said Timothy Welsh, founder and CEO of wealth management consulting firm Nexus Strategy.

And world famous AOC criticized the brokers actions, she is a member of the Financial Services Committee and would support a hearing.

A few days ago senator Elizabeth Warren said something had to be done, I believe she meant bail out her billionaire buddies.

As you may know there is a divide in the US democrat party, between socialists (incl AOC) and "typical" dems.

This will get politicized, and your portfolio returns will depend directly on US politics.

Also, if these plays continue to be possible will depend on US congress and NOT on magical indicators.

The left in the US (the people around Bernie Sanders) will likely fight in favor of the small guy, republicans and old school democrats will defend "systemic risk" in other words the big funds, libertarians (a few republicans + Tulsi Gabbard I'd say) might defend retail investors.

But I really expect the same old dems & republicans to win and stop the infinite free money hack, a lot of people really won't like it, and it adds another brick to the wall of divide+tensions+radicalisation.

Billionaires will get bailed out, but since they burned themselves I think they are going to calm down with the shorting and fear mongering.

Unless crazy laws that overwhelmingly favor them get voted, at that point this would not even surprise me...

For once the little guys won and beat the corrupt insiders, and so they cheated to avoid losing.

Not

And here we go again. More divide & conquer. AMC & GME longs are being called racist. "They bought because they are antisemite".How are people still falling for this I do not know.

It was revealed that Nancy Pelosi on Dec 22 2020 bought 25 Tesla call options (for 500k-1MM) with a $500 strike price and an expiration date of 3/12/2022.

1 day before Biden announced he planned to replace all government cars with EVS.

The plebes have to close their business while Amazon & friends are open and make record profits.

The plebes have to be locked at home while their overlords party and fine dine.

The plebes are banned from making money while hedge funds make billions, take Ackman that suggested we shut down as he was shorting the stock market...

I could go on but I'll keep it short. Just so much lies, corruptions, and "elite" games.

Big things are going to happen. This will have impacts in Forex even but I don't know how much (until the USD disappears).

Oh Robinhood & friends have sometimes said they had "issues" with crypto, so crypto gamblers might learn a harsh lesson soon.

Better keep our eyes open.

Not

Ok and so here is the conclusion. This guy has always been honest...Thomas Peterffy Interactive Broker CEO (the other Hungarian billionaire) just said on tv (CNBC) the short squeeze would have kept "going and going".

GME went from 140% SI to (estimated) 95-100%, so yes it would have kept going!

So regulators & brokers agreed to stop it all to "stop the losses".

"Honestly we did it to protect ourselves".

"We did it to protect our customers.. most of all to the market place and the clearing house".

You can find the interview on CNBC Television

Peterffy is the only one being honest AND when little guys lost tens of thousands and even went into debt when Oil went negative he decided to cover for his clients, IB took the losses.

If you have not seen Ray Dalio videos about market cycles and social tensions I recommend watching...

Some rich guy Leon Cooperman on tv have cried that "this fair share is a bs concept and a way to attack wealthy people".

Inequality still growing, helped by covid lockdowns for small businesses and record profit for billionaires. Rich guys are starting to feel they are getting squeezed, and the masses want their "fair share" as they are getting wronged. Debt is just enormous. Really just the textbook stuff going as planned.

Occupy Wall Street 2?

Not

Ok I think Robinhood got scared by the anger from their clients and they are reverting the ban.I won't tell anyone what to do but I wanted to mention this, and also there could be a tug of war and it all could be risky, they could go to court and you know convince everyone that GME etc buyers are "racist" and lots of people are dumb enough to believe it, they could sue retail for "manipulation coming from an antisemitic forum" and make you pay, with the crowd cheering "hurray we defeated racism", or these stocks could keep going up and up and up.

I don't want to make any advice to buy or sell, just wanted to clear things up, Robinhood is reopening, things could go well or not. Do your DD.

This is my last update on this idea.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.