EQT’s buyout exit win rests on inimitable playbook

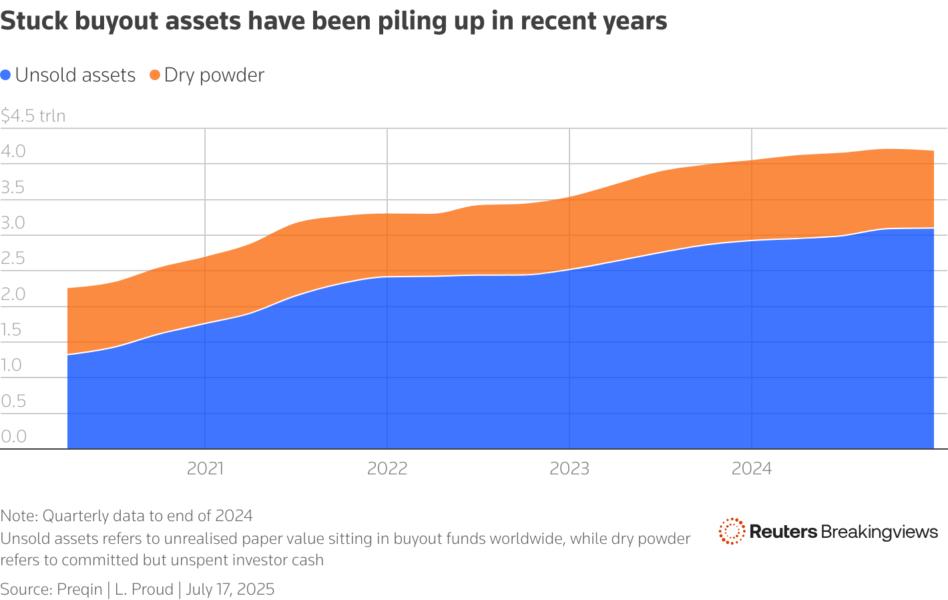

The big question for the private-equity industry is whether it can get rid of well over $3 trillion in stuck assets. First-half results for Sweden’s EQT EQT, with $300 billion under management, at first glance suggest that the answer may be yes. The reality is more complicated.

The Stockholm-based group, run since May by Per Franzén, on Thursday revealed that it had disposed of about $15 billion worth of portfolio company equity stakes across its stable of funds during the first half of 2025. That was more than triple the equivalent figure for the same period a year earlier, and exceeded the entire so-called “exit value” across the whole of 2024.

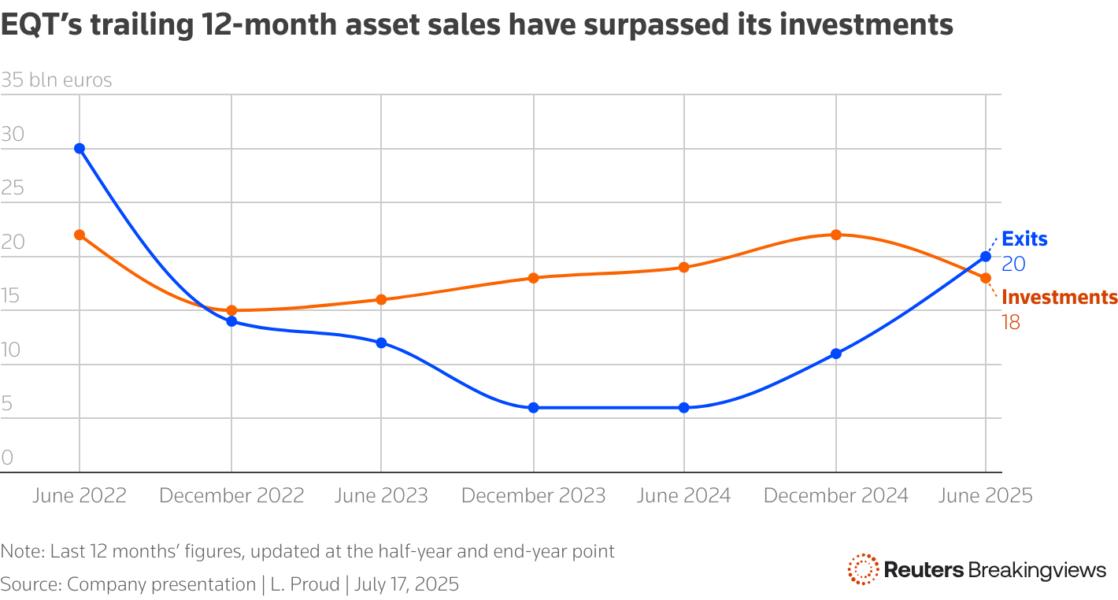

Crucially for Franzén’s pension and sovereign wealth fund backers, known as limited partners (LPs), exits over the past 12 months were greater than fresh investments. If the rest of the private-equity industry were able to mimic that achievement, LPs would finally find themselves receiving more cash from older buyout vehicles than they’re contributing. That would then allow them to pump more money into the next generation of funds rather than continuing to sit on their hands.

That’s a big “if”. Some of the details of EQT’s exit win are less reassuring than the headline number. First, just over half of the total came from full disposals of portfolio companies, according to a person familiar with the matter, including the sale of Karo Healthcare to KKR and Acumatica to Vista Equity Partners. It’s notable that those two businesses relate to EQT’s core sectors of healthcare and technology, which tend to be faster-growing sectors that elicit more investor interest.

Franzén’s dealmakers only managed to partially exit the rest. Public-market share sales accounted for a fifth of the total but relied heavily on offloading stock in companies that EQT had already listed, like Galderma GALD, Azelis

AZE and Waystar

WAY. But that hardly suggests a thaw in the initial public offering market: selling a stake in an already established public company is easier than launching a fresh IPO.

The final bucket, accounting for about a fifth to a quarter of the total, came from two big deals: a minority stake sale in cloud-software group IFS and a complex transaction involving Nord Anglia Education, where EQT sold the private-school chain to a consortium of investors that included one of its newer funds.

Those kinds of bespoke deals, in which a fund manager sells an asset to itself alongside minority investors, only tend to work for businesses that are proven winners, and for managers with high returns and deep LP relationships. EQT, which is now the second largest private-equity firm in the world as measured by capital raised over the past five years, fits that description. But its relative success will bring little cheer to the wider buyout industry.

Follow Liam Proud on Bluesky and LinkedIn.

CONTEXT NEWS

Private equity group EQT on July 17 said that it had sold 13 billion euros’ worth of investments during the first half of 2025, which was more than triple the equivalent figure for a year earlier and greater than its entire exit value during the whole of 2024.

Marquee deals included a minority stake sale of cloud-software group IFS, which valued the business at over 15 billion euros including debt, and a complex transaction involving private-school chain Nord Anglia Education. One of EQT’s newer funds bought into the business alongside the Canada Pension Plan Investment Board and Neuberger Berman.

Public-market exits represented a fifth of the first-half total, the Swedish company said, and included a selldown of already listed skincare group Galderma.

EQT’s shares were roughly flat as of 0826 GMT on July 17.